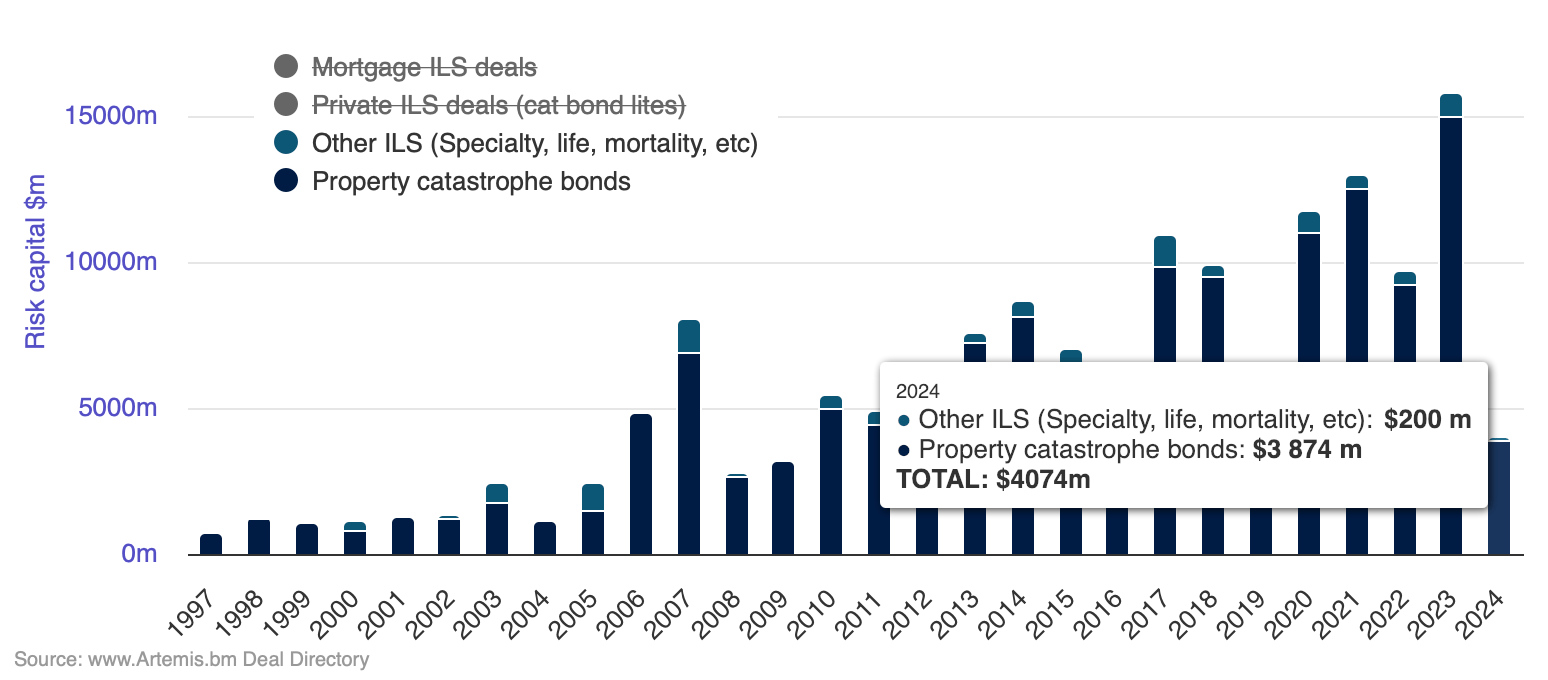

The primary-quarter of 2024 has seen information fall within the disaster bond market and the interval is the primary time that the beginning months of the 12 months have ever seen over $4 billion of 144A disaster bond issuance, in accordance with Artemis’ knowledge.

Our new quarterly disaster bond market report will probably be revealed subsequent week and it’ll assessment the entire quarter’s key cat bond issuance knowledge factors. Be careful for our announcement subsequent week when it’s launched, or you’ll be able to at all times discover all of our quarterly cat bond market experiences right here.

However, our disaster bond market charts and visualisations are stored updated as each new deal settles or previous cat bonds mature, so you’ll be able to sustain with issuance because it progresses all year long.

Now, with the final two new disaster bonds of the first-quarter settling as we speak, it’s clear from the info that Q1 2024 has set new information, a notable considered one of which we thought we’d spotlight as we speak.

It’s the first first-quarter of any 12 months the place 144A disaster bond issuance has reached above $4 billion.

The earlier report was 2020, when 144A issuance reached $3.96 billion, so it’s solely only a report, however nonetheless a notable one we really feel.

This 12 months, January 2024 noticed the second highest stage of recent cat bond issuance on report for the month, however it’s actually March that has pushed the information.

March 2024 noticed nearly $2.3 billion of 144A disaster bonds issued, setting a brand new report for the month.

It’s an distinctive begin to the 12 months and now the market pipeline already has $1.84 billion of issuance scheduled for April, a few of which is sort of assured to upsize, some maybe considerably.

The report for April issuance was set in 2023 with simply over $2 billion of issuance, so we might simply see one other report month this 12 months.

2024 is on-track to be a really sturdy issuance 12 months and with a lot of bigger offers additionally anticipated and demand for reinsurance rising basically, there’s each cause to be optimistic {that a} new annual report will probably be set.

Simply final week, we polled our readers for his or her opinions as to how excessive 2024 disaster bond issuance might rise and greater than 35% of respondents stated they anticipate it is going to be above $17 billion, whereas 16% anticipate $20 billion will probably be surpassed in 2024.

There’s a lengthy solution to go earlier than we attain that stage and we’ve a complete hurricane season forward of the trade.

However, the foundations have been set and with returns nonetheless significantly extra engaging than a number of years in the past and the price of threat switch within the cat bond market compelling for sponsors and providing actual worth by threat capital diversification, there’s each probability we hit these ranges and see a brand new report set this 12 months.

The Artemis Deal Listing lists all disaster bond and associated transactions accomplished because the market was fashioned within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the prime of the listing.

Obtain our free quarterly disaster bond market experiences.

We monitor disaster bond and associated ILS issuance knowledge, essentially the most prolific sponsors out there, most energetic structuring and bookrunning banks and brokers, which threat modellers function in cat bonds most continuously, plus a lot extra.

Discover all of our charts and knowledge right here, or by way of the Artemis Dashboard which offers a helpful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.