Allstate has considerably lifted the highest of its Nationwide extra disaster reinsurance tower to simply over $7.9 billion, which is sort of a $1 billion improve from the prior 12 months and disaster bonds are filling out a lot of the upper-layers.

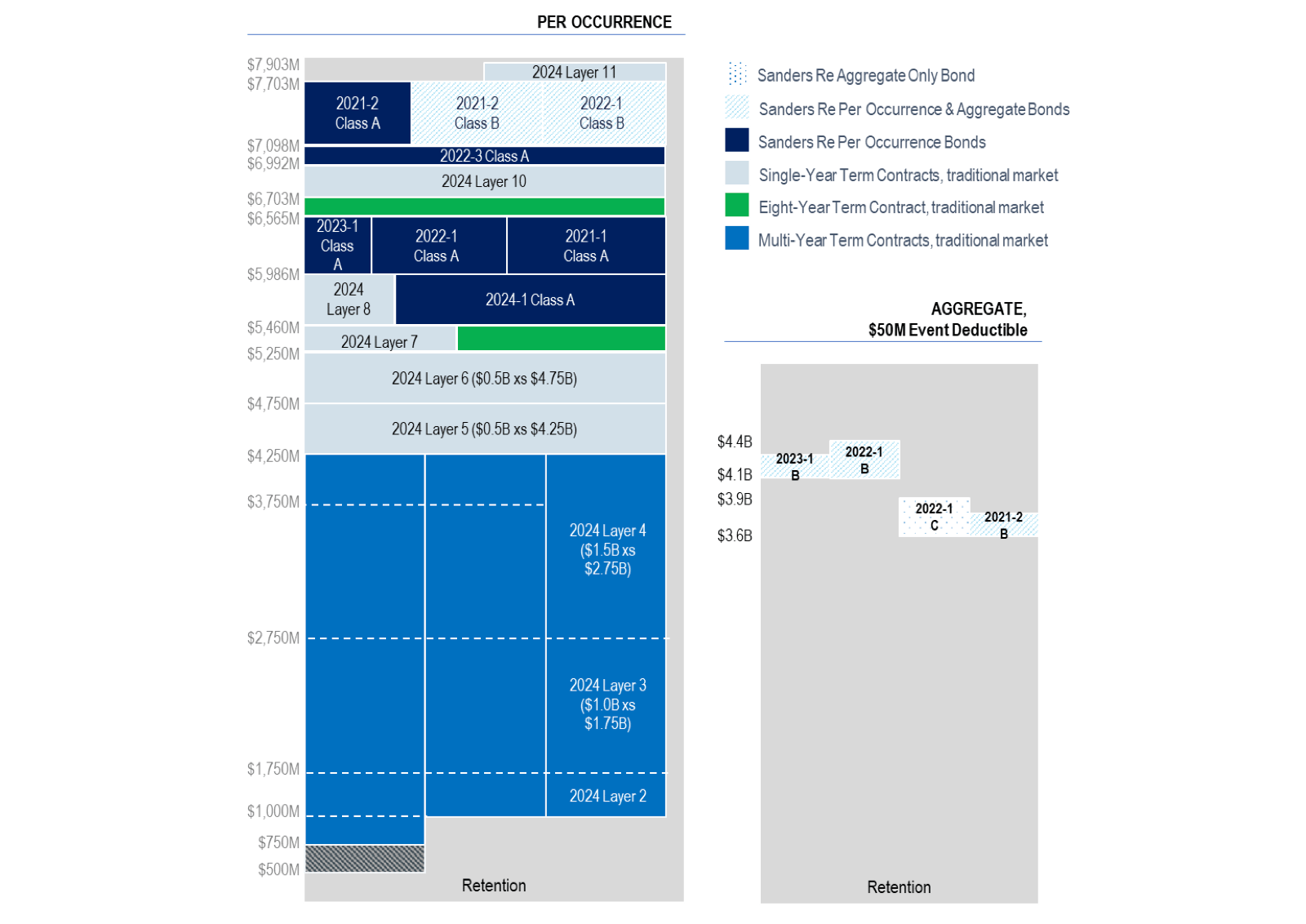

Secured for 2024, the $400 million Sanders Re III Ltd. (Collection 2024-1) disaster bond issued in January is the newest ILS market addition and occupies an necessary slot within the tower, overlaying 76% of a layer attaching at $5.46 billion and operating to nearly $6 billion of losses.

Vital new conventional reinsurance purchases have additionally bulked out the tower and helped Allstate to develop it to the brand new approaching $8 billion degree.

However, similtaneously the highest of Allstate’s major nationwide disaster reinsurance tower extending by roughly $1 billion, on the different finish there’s extra danger now being retained.

The place as, in 2023, Allstate’s Nationwide Extra Disaster Reinsurance Program lined it for losses of as much as $6.92 billion after retentions of between $500 million and $750 million, the retentions have now elevated.

For 2024, Allstate’s Nationwide disaster reinsurance tower gives protection for loss occasions as much as $7.90 billion, after retentions of $500 million to $1 billion.

One other notable change is that Allstate now not has mixture reinsurance protection that incorporates a franchise deductible.

With the combination reinsurance tower solely offered by disaster bonds, the outdated Sanders cat bonds that had a $1 million franchise deductible aren’t any extra.

Now, Allstate solely has 4 tranches of cat bonds that present mixture reinsurance, however characteristic a $50 million occasion deductible as a substitute.

Recall that, we reported lately on the final tranche of mixture cat bond notes that featured a franchise deductible to disclose that qualifying losses from the chance interval that ended March thirty first 2024 at the moment are very near attaching the protection and so Allstate could profit from recoveries beneath that tranche, ought to loss growth proceed.

However, that tranche was because of mature anyway, so now not options within the insurers reinsurance applications from April 1st this 12 months. However it would keep out there for any recoveries that may be made, ought to the combination loss tally creep greater and fix the protection.

Positioned within the conventional reinsurance market in 2024 for Allstate have been multi-year contracts attaching on the $500 million to $1 billion retentions and offering protection of as much as $4.25 billion, so exhausting at $4.75 billion.

As well as, Allstate positioned two eight-year time period reinsurance contracts, that present it $105 million of canopy in extra of a minimal $5.25 billion retention and $131 million of canopy in extra of a minimal $6.57 billion retention.

Allstate additionally positioned 5 single-year time period reinsurance agreements in 2024 as effectively, which have a spread of attachment and exhaustion factors all through the Nationwide disaster reinsurance tower.

You’ll be able to see how Allstate’s Nationwide reinsurance towers checked out April 1st 2024 under:

Allstate additionally bought a Canadian disaster reinsurance association at January 2024, offering whole protection of CA$355 million in extra of a CA$75 million retention.

One different notable reality, associated to Allstate’s reinsurance preparations for 2024, is the elevated price related to its procurement.

Whereas extra restrict has been secured, the price of Allstate’s reinsurance has risen sooner, it appears.

Allstate stated that the overall price of its property disaster reinsurance applications, excluding reinstatement premiums, was $286 million in Q1 2024, in comparison with $219 million in Q1 2023.

As well as, Allstate has disclosed that its reinsurance preparations price it $1.02 billion in 2023, which was up considerably from $788 million in 2022.

However, Allstate has been steadily filling out the upper-layers of its reinsurance tower during the last two years, largely with disaster bonds, and has now prolonged it by nearly $1 billion, so the elevated prices are comprehensible, together with the results of the onerous reinsurance market.

View particulars of each disaster bond ever sponsored by Allstate right here.