US main insurer Allstate added $343 million of disaster losses within the month of March, taking its Q1 2024 cat loss complete to $731 million, suggesting additional erosion of the retention beneath the agency’s combination reinsurance cat bond protection, though the info means that the tranches of notes do seem secure from precise losses.

February cat losses got here in beneath the $150 million reporting threshold, however Allstate has at the moment introduced that cat losses in March totalled $343 million, 80% of which pertains to one hail occasion, which takes complete cat losses for the primary quarter of 2024 to $731 million.

Add the Q1 2024 complete to the $3.9 billion recorded within the annual danger interval which aligns with its in-force Sanders Re cat bonds, and it seems that Allstate has racked up aggregated qualifying losses of some $4.68 billion.

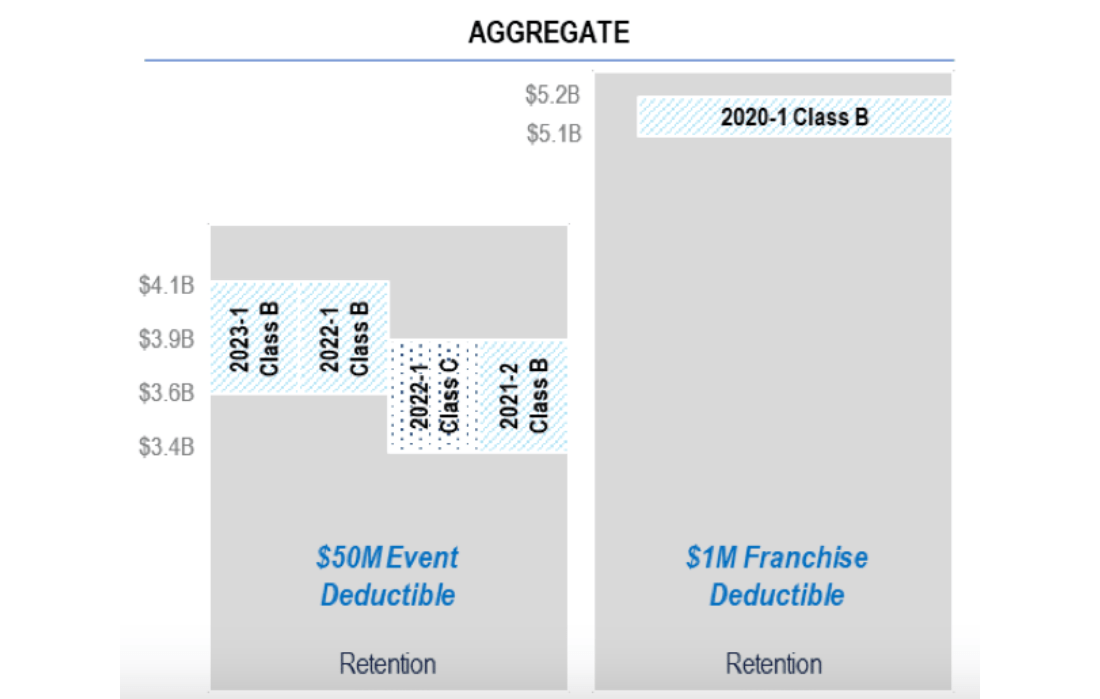

As we’ve mentioned earlier than, the $100 million Sanders Re II Ltd. (Collection 2020-1) Class B tranche of notes, which includes a $1 million franchise deductible, connect at $5.1 billion of aggregated qualifying losses, and sources advised Artemis beforehand that after the January cat losses, some 82% of the retention beneath had been eroded.

On the identical time, we reported that the Sanders Re cat bonds that present combination reinsurance to Allstate however function a $50 million per-event deductible had seen their retentions eroded by greater than 50%, and these notes start to connect at $3.4 billion of qualifying losses.

With qualifying losses near $4.7 billion after the exercise in Q1 2024, had been each occasion to have certified it might have appeared that Allstate had eroded roughly 92% of the retention that sits beneath the Sanders Re II Ltd. (Collection 2020-1) Class B tranche of notes, which attaches at $5.1 billion.

For the Sanders Re disaster bonds that present combination reinsurance to Allstate however function a $50 million per-event deductible, sources advised Artemis that by the tip of 2023, qualifying losses for these occasion deductible combination Sanders Re cat bonds stood at $1.9 billion, that means that their deductibles had been all greater than 50% eroded.

Given the bottom attaching are at $3.4 billion, and with the extra $731 million of Q1 2024 cat losses, which if all is included takes qualifying losses to greater than $2.6 billion, it seems these cat bond notes are secure from triggering, though with out seeing the official occasion studies we can’t 100% affirm that.

In reality, the $2.6 billion may nicely be too excessive for an combination loss determine for these cat bond tranches, as we don’t understand how most of the occasions had been truly above $50 million, however on the degree of losses reported and the place the aggregated loss determine was at year-end 2023, it appears these bonds gained’t face losses from the now ended annual combination danger interval.

Precisely how shut the notes had been to being triggered is obscure, partly due to the several types of deductibles that function, that means that the cat bonds don’t combination losses from the ground-up, whereas the notes additionally cowl solely sure perils and portfolios of the first insurer’s underwritten danger.

However what is obvious is that the document degree of extreme convective storm exercise within the US in 2023, which has continued into 2024, got here near fully eroding the $5.1 billion retention for the franchise deductible notes.

As a reminder, you may see the place every kind of Sanders Re combination cat bond sits in Allstate’s reinsurance tower within the diagram beneath:

For the first-quarter of 2023, Allstate reported pre-tax disaster losses of $1.69 billion, with $1.17 billion from March alone on account of extreme and convective climate occasions. So, whereas wind and hail occasions within the US have once more been the motive force of world insured losses within the first quarter of the yr, they’ve come down by round 57% year-on-year for Allstate.

Throughout Q1 2024, Allstate additionally recorded some beneficial prior yr reserve reestimates for prior occasions, which dropped the quarterly cat invoice to $328 million.