A standard query we see yearly is “can you’re taking out extra pupil mortgage debt than you want?” It sounds loopy, however some folks wish to benefit from the low mounted prices and mortgage forgiveness choices than could come sooner or later.

With the rising prices of tuition, charges, and faculty dwelling bills, financing a school schooling is changing into more and more tough.

The actual fact stays that many college students will apply for pupil loans. And whereas loans present important monetary assist, they arrive with important accountability and long-term implications.

So how a lot do you actually need? How a lot must you settle for? And must you borrow greater than you want?

Making knowledgeable monetary choices now can really set your self up for achievement later, and pupil loans are an incredible instance of this. So learn on to begin constructing good monetary habits!

Latest Traits In Pupil Mortgage Debt

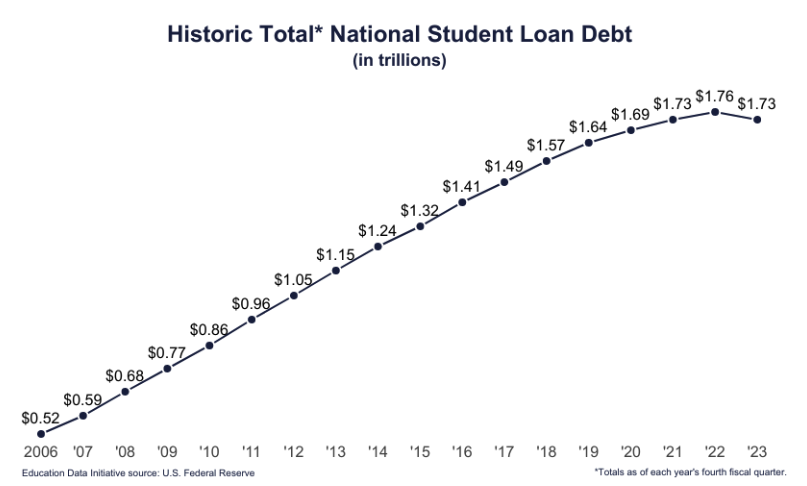

Pupil mortgage debt has grown tremendously over the past twenty years and is now one of many prime sorts of shopper debt throughout the nation. This shouldn’t come as a shock whenever you study that the price to attend faculty has greater than doubled prior to now 4 many years.

Who units the worth of tuition anyway? In lots of instances, the establishment’s native governing board units tuition charges. However there has additionally been an elevated demand for school schooling throughout the board. These elements, mixed with much less authorities funding and growing overhead prices, contribute to increased prices so that you can pursue increased schooling.

Pupil mortgage debt within the US comes out to $1.7 trillion. And whereas the latest years have truly skilled a slight decline in pupil mortgage debt, greater than half of our college students proceed to graduate with mortgage debt. The truth is, the present common pupil debt stability is $37,718, and the typical US family owes $55,347 in pupil debt. Excuse my pun, however it actually pays to know what you’re agreeing to whenever you signal on your pupil loans.

Associated:

How Pupil Loans Work

Elements That Add To Pupil Mortgage Debt

A number of elements contribute to college students taking out extra loans than they want. And it doesn’t assist that lenders typically supply greater than sufficient to cowl tuition bills. Listed below are some influencing elements to bear in mind so you possibly can borrow responsibly:

Overestimating Your Bills: College students are inclined to overestimate their faculty bills once they don’t know the true price of attendance, misjudge dwelling bills, or neglect to think about extra earnings or cost-saving alternatives.

Social and Peer Stress: Similar to in different elements of life, peer stress can play a big position in your borrowing choices because of the want to slot in, preserve the identical way of life as buddies, and sustain with new spending habits.

Restricted Monetary Assist: There could also be quite a lot of causes you end up unable to qualify for federal grants, college scholarships, or different types of monetary assist and, as a substitute, flip to pupil loans to fill the monetary hole.

Misinformation: There are a complete host of selling ways utilized by lenders to encourage college students to borrow greater than they want or can afford. I can’t overstate the significance of building your monetary literacy earlier than borrowing pupil loans.

Emergencies: Lastly, unexpected circumstances or sudden bills can immediate college students to borrow extra loans, shortly compounding your debt stability if not managed responsibly.

How A lot Can I Borrow?

It’s true you could take out extra pupil mortgage debt than you want in some instances, however must you? Pupil loans are a gateway to receiving your faculty diploma, however you wish to be certain your loans are manageable.

Fortuitously on your future, financially savvy self, there’s a restrict to how a lot you possibly can borrow. Your restrict for federal loans depends upon just a few issues: whether or not you will be claimed as a dependent, your present yr at school, and the kind of mortgage you’re taking out.

As of 2024, undergraduates can borrow a most of $5,500 to $12,500 annually, or a complete of $57,500. Graduate college students can borrow as much as $20,500 annually, or $138,500 in whole (together with undergraduate loans). How a lot you possibly can borrow depends upon your standing (dependent or unbiased pupil), yr of faculty, and the college’s price of attendance.

You can not borrow any sort of certified schooling mortgage past the price of attendance.

See a full breakdown of the scholar mortgage borrowing limits right here.

The utmost quantity out there to borrow via non-public pupil loans varies by lender, and it’s possible you’ll even have the ability to borrow the quantity that matches your price of attendance. However, once more, borrowing the utmost quantity out there to you isn’t typically the only option, principally as a result of pupil mortgage debt poses important monetary accountability till it’s paid off.

Bear in mind, whereas sponsored loans embody particular agreements – like the place the US Division of Schooling pays curiosity in your loans whilst you’re at school and for the primary six months after leaving faculty – direct loans begin accruing curiosity once they’re disbursed. Both approach, you’ll wish to issue on this extra price over the lifetime of the mortgage.

Associated: How To Take Out A Pupil Mortgage (Federal And Personal)

Penalties Of Extreme Pupil Mortgage Debt

Extreme pupil mortgage debt may cause undue stress for debtors properly after commencement. It’s price discussing these impacts forward of time, so you’ve gotten an concept of how your monetary well-being could also be altered down the highway. Hopefully, understanding these unintended penalties earlier than they happen will enable you make knowledgeable borrowing choices now.

Listed below are frequent negative effects of extreme pupil mortgage debt:

Monetary Pressure: The obvious consequence of getting excessive pupil mortgage debt is the monetary pressure it creates. Having a excessive month-to-month cost shortly eats away at your whole buying energy, and it will possibly grow to be tough to fulfill different monetary obligations. After all, the curiosity accrued on loans typically means debtors pay again way over the quantity they initially acquired, which might additional stunt your progress towards different monetary targets.

Delayed Milestones: Most of us produce other life targets past faculty and work, together with getting married, beginning a household, or proudly owning a house. However excessive debt funds can pose challenges to build up financial savings, protecting wedding ceremony bills, or affording the down cost on a house.

Monetary Well being: Sadly, missed or late mortgage funds can harm a borrower’s credit score rating in a single day. Having a low credit score rating within the US indicators to lenders that you’re a riskier borrower, which makes it harder to acquire new loans, bank cards, and even favorable rates of interest.

Psychological and Emotional Stress: Any one of many objects above is sufficient to take a toll in your psychological and emotional well-being. Mixed, the stress and anxiousness of managing extreme debt can really feel overwhelming.

Restricted Put up-Grad Alternatives: Much less important however nonetheless vital to pay attention to, having excessive ranges of undergraduate mortgage debt could deter you from pursuing new post-grad alternatives. A standard feeling right here is the stress to prioritize higher-paying jobs over different targets or positions you’re eager about.

How To Keep away from Borrowing Extra Than You Want

The prospect of pupil mortgage debt will be daunting, however there are a number of methods to remember the fact that will assist scale back your whole borrowing quantity and assist you to make knowledgeable monetary choices. All of it begins with planning for what you’ll really need.

Writing out your funds is step one to responsibly managing your bills and avoiding extreme borrowing. Rigorously observe your anticipated earnings and bills annually to establish how a lot you’ll must cowl the requirements. Then, discover areas the place you possibly can lower prices to prioritize spending on schooling necessities. Take into account downloading a funds app in your telephone to assist observe your targets and spending.

Subsequent, attempt to maximize your monetary assist bundle by benefiting from all choices out there to you. That features making use of for federal assist, grants, scholarships, and different tuition help packages supplied by your college, employer, or a group group.

For instance, a number of small banks supply scholarships to native candidates. Receiving even a further $2,500 reduces your whole debt burden.

One other frequent tactic to scale back mortgage debt is discovering part-time employment or enrolling in a work-study program. Any added earnings will offset the general monetary burden to you – and also you’ll acquire beneficial job expertise alongside the best way.

Lastly, be sure to’re borrowing responsibly. Earlier than accepting any mortgage supply, learn via the phrases and situations, paying particular consideration the rates of interest, compensation plans, and mortgage forgiveness choices. You’ll be able to go a step additional by estimating your future incomes potential and your capability to repay loans after commencement. However, most significantly, decide what you completely must borrow to fulfill your wants proper now, and attempt to chorus from accepting something greater than that.

The Takeaway

Pupil mortgage debt is a posh and extremely private matter. Receiving the monetary means to pursue increased schooling has far-reaching implications on your private development, profession development, and lifelong success. On the similar time, accepting extreme pupil loans can have unintended penalties in your future targets, well being, and monetary well-being.

With faculty tuition on the rise, it’s extraordinarily vital that you just perceive the fundamentals of pupil mortgage agreements, make knowledgeable choices, and actively handle your mortgage debt. Prioritizing monetary literacy, maximizing monetary assist, and searching for different financing choices are 3 ways to attenuate the impacts of pupil mortgage debt after commencement.

And, above all, don’t neglect to plan for the longer term! Your future self will thanks.