Almost 2 million Aussies affected in 2022-23

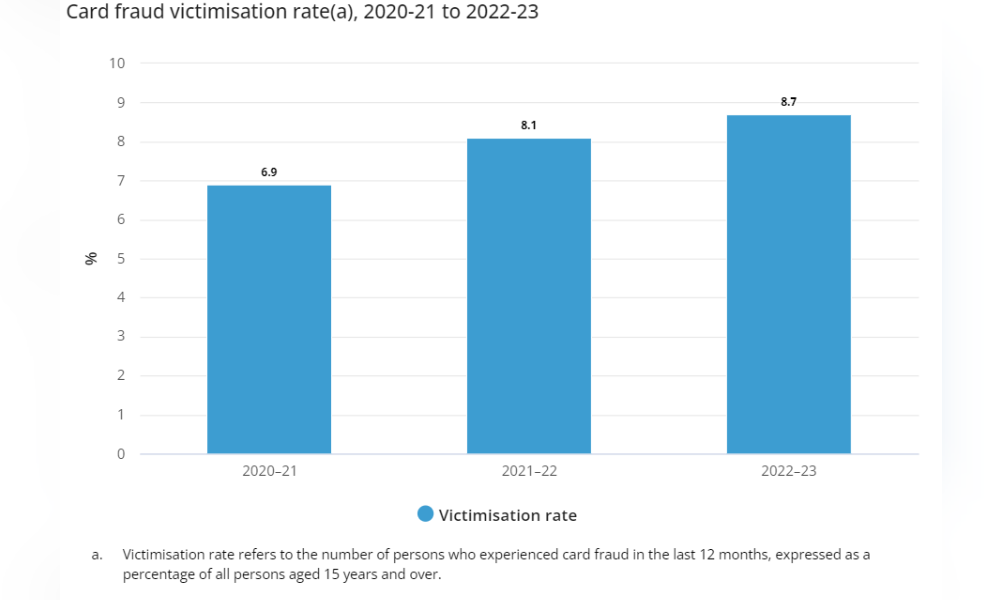

ABS has revealed a pointy rise in card fraud incidents, with almost 9% of Australians falling sufferer within the final monetary 12 months.

William Milne, ABS’ head of crime and justice statistics, highlighted a major improve in card fraud victims to eight.7% of Australians in 2022-23, up from 8.1% the earlier 12 months.

The vast majority of card fraud incidents concerned comparatively small quantities, with one-third (34%) of victims dropping lower than $100, although one in six (18%) suffered losses over $1,000.

“The median quantity that was fraudulently withdrawn or spent was round $200 for every card fraud incident,” Milne stated in a media launch.

An amazing majority of card fraud victims, 98%, reported the incident, with 92% contacting their financial institution or monetary establishment.

Along with card fraud, half 1,000,000 Australians had been scammed in 2022-23, with shopping for or promoting scams, together with false billing and on-line procuring frauds, being most prevalent.

Greater than two-thirds (69%) of rip-off victims reported the incident, typically to a financial institution or monetary establishment, which accounted for 49% of notifications.

ABS’ 2022-23 Private Fraud Survey particulars the charges of card fraud, identification theft, on-line impersonation, and sure scams, together with socio-demographic profiles of the affected people.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter.

Sustain with the most recent information and occasions

Be part of our mailing record, it’s free!