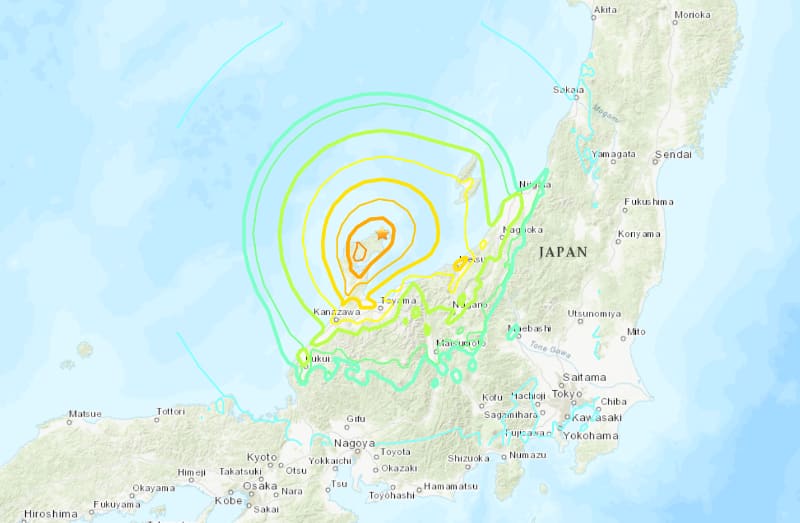

Insurance coverage claims paid for the January 1st M7.5 earthquake that hit close to the Noto Peninsula in Ishikawa prefecture, Japan, are presently operating at nearly US $415 million, in accordance with the most recent knowledge from the Basic Insurance coverage Affiliation of Japan.

Important property injury was skilled and because the insurance coverage and reinsurance market loss estimates started to come back out, it was clear the occasion was a comparatively vital one for the home insurance coverage trade, with the potential for some minor world reinsurance results as properly.

Now, we have now the primary correct view of how the claims funds are flowing, with the Basic Insurance coverage Affiliation of Japan (GIAJ) explaining that the entire has reached over JPY 61 billion as of March eighth 2024.

At that date the determine transformed to simply below US $415 million, or at at this time’s date it’s nearer $405 million on account of foreign money fluctuations (word, it will have been over US $430 million on the time the quake occurred).

The GIAJ stated that as of March eighth there had been 115,211 accepted insurance coverage claims for injury to homes and family items, whereas 95,601 investigations have been made into claims filed up to now.

Some 67,413 claims funds have been made, ensuing within the greater than JPY 61 billion claims funds made to March eighth.

To date, the 2024 Noto Peninsula earthquake loss is the seventh largest insured loss from a Japanese earthquake occasion up to now.

Keep in mind that the figures from the GIAJ are overlaying member corporations of the Basic Insurance coverage Affiliation of Japan and the Overseas Non-Life Insurance coverage Affiliation of Japan.

Because of this, they don’t embody all losses to world re/insurers working in Japan, as some might not be members.

Recall that, the primary trade loss estimate to be launched for this Japanese earthquake was from modelling agency Karen Clark & Firm (KCC), which put the insured losses from the quake at an estimated $6.4 billion.

The following to challenge an insurance coverage market loss estimate for the Japanese earthquake was CoreLogic, which stated it’s prone to be under $5 billion.

So, trade loss estimates from the principle insurance coverage and reinsurance market danger modelling companies ranged from as little as US $1.8 billion to as excessive as US $6 billion and the GIAJ knowledge we now have, after over two months because the earthquake, would possibly counsel the reality is someplace within the lower-half of that vary no less than.