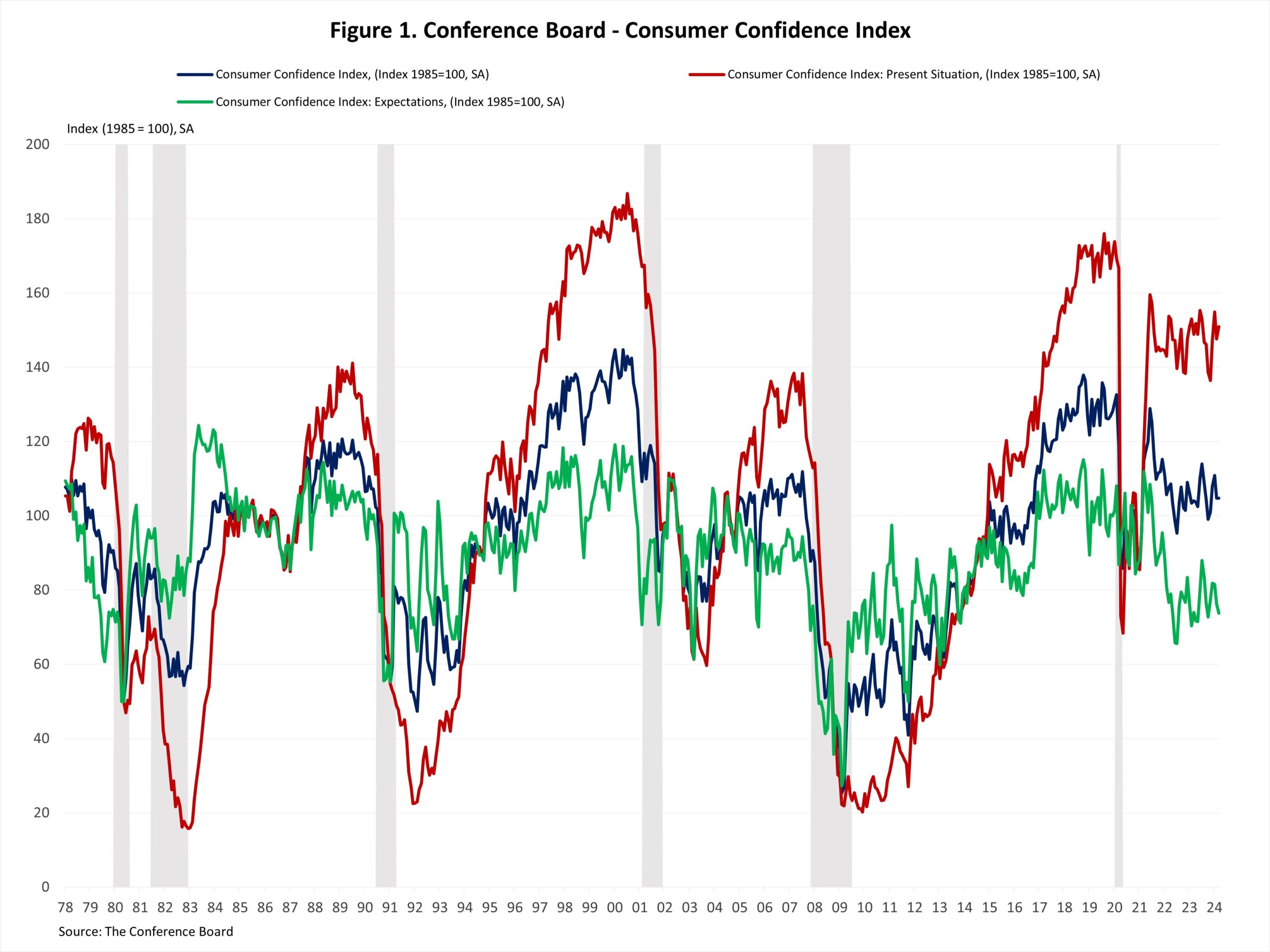

Client confidence held regular in March, with optimism about present situations offset by considerations concerning the future financial outlook. This pessimism was primarily pushed by persistent inflation, particularly elevated meals and gasoline costs.

The Client Confidence Index, reported by the Convention Board, stood just about unchanged at 104.7 in March, the bottom degree since November 2023. The Current State of affairs Index rose 3.4 factors from 147.6 to 151.0, whereas the Expectation State of affairs Index fell 2.5 factors from 76.3 to 73.8. Traditionally, an Expectation Index studying under 80 typically indicators a recession inside a yr.

Shoppers’ evaluation of present enterprise situations fell barely in March. The share of respondents score enterprise situations as “good” decreased by 0.9 proportion factors to 19.5%, however these claiming enterprise situations as “unhealthy” additionally fell by 0.5 proportion factors to 17.2%. In the meantime, shoppers’ assessments of the labor market had been extra constructive. The share of respondents reporting that jobs had been “plentiful” elevated by 0.3 proportion factors, whereas those that noticed jobs as “onerous to get” fell by 1.8 proportion factors.

Shoppers had been extra pessimistic concerning the short-term outlook. Whereas the share of respondents anticipating enterprise situations to enhance rose from 14.0% to 14.3%, these anticipating enterprise situations to deteriorate elevated from 16.9% to 17.6%. Equally, expectations of employment over the subsequent six months had been much less favorable; The share of respondents anticipating “extra jobs” decreased by 0.2 proportion factors to 13.9%, and people anticipating “fewer jobs” elevated by 0.7 proportion factors to 18.2%.

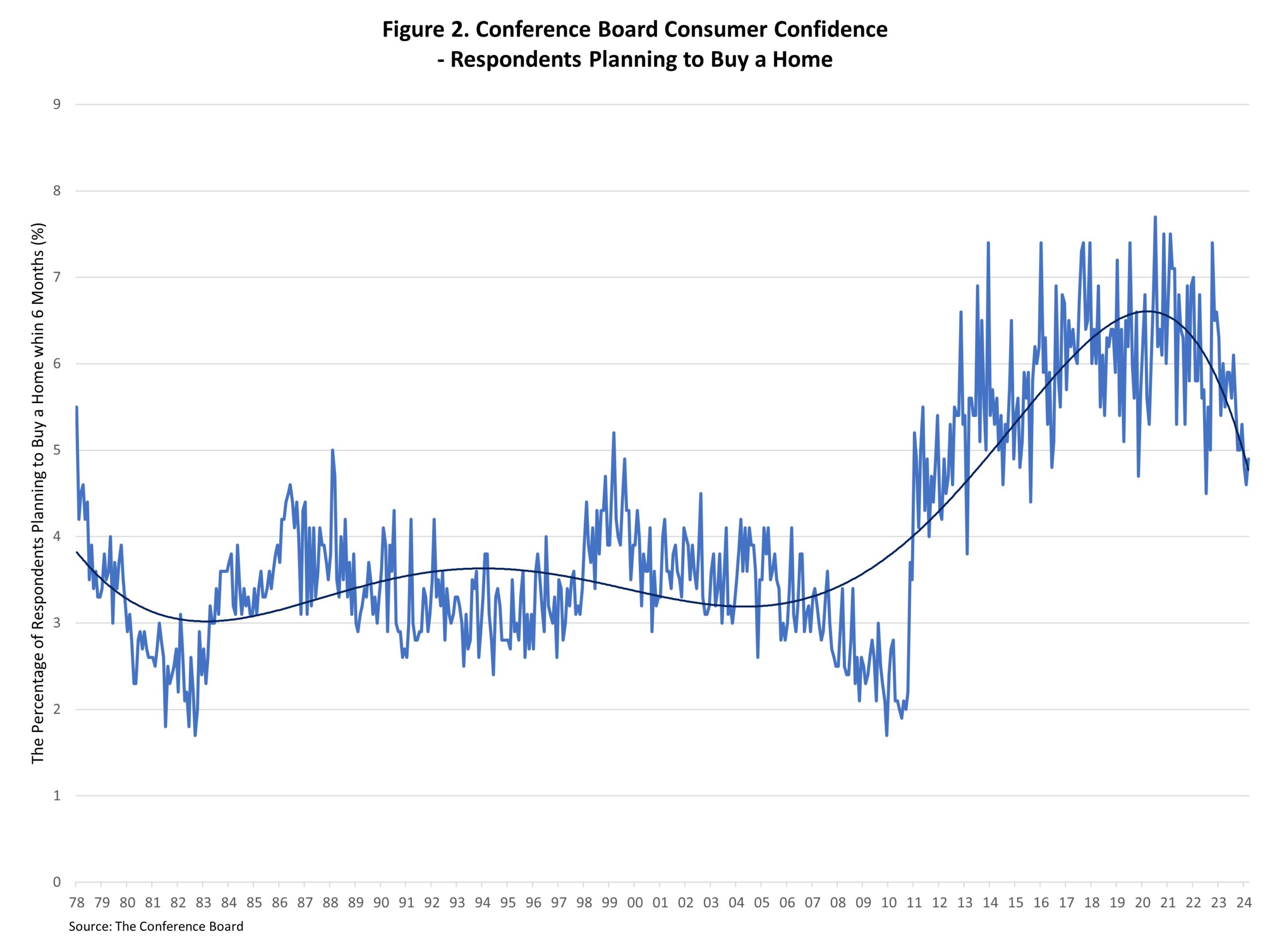

The Convention Board additionally reported the share of respondents planning to purchase a house inside six months. The share of respondents planning to purchase a house elevated to 4.9% in March. Of these, respondents planning to purchase a newly constructed dwelling remained at 0.3%, and people planning to purchase an current dwelling climbed to 2%.