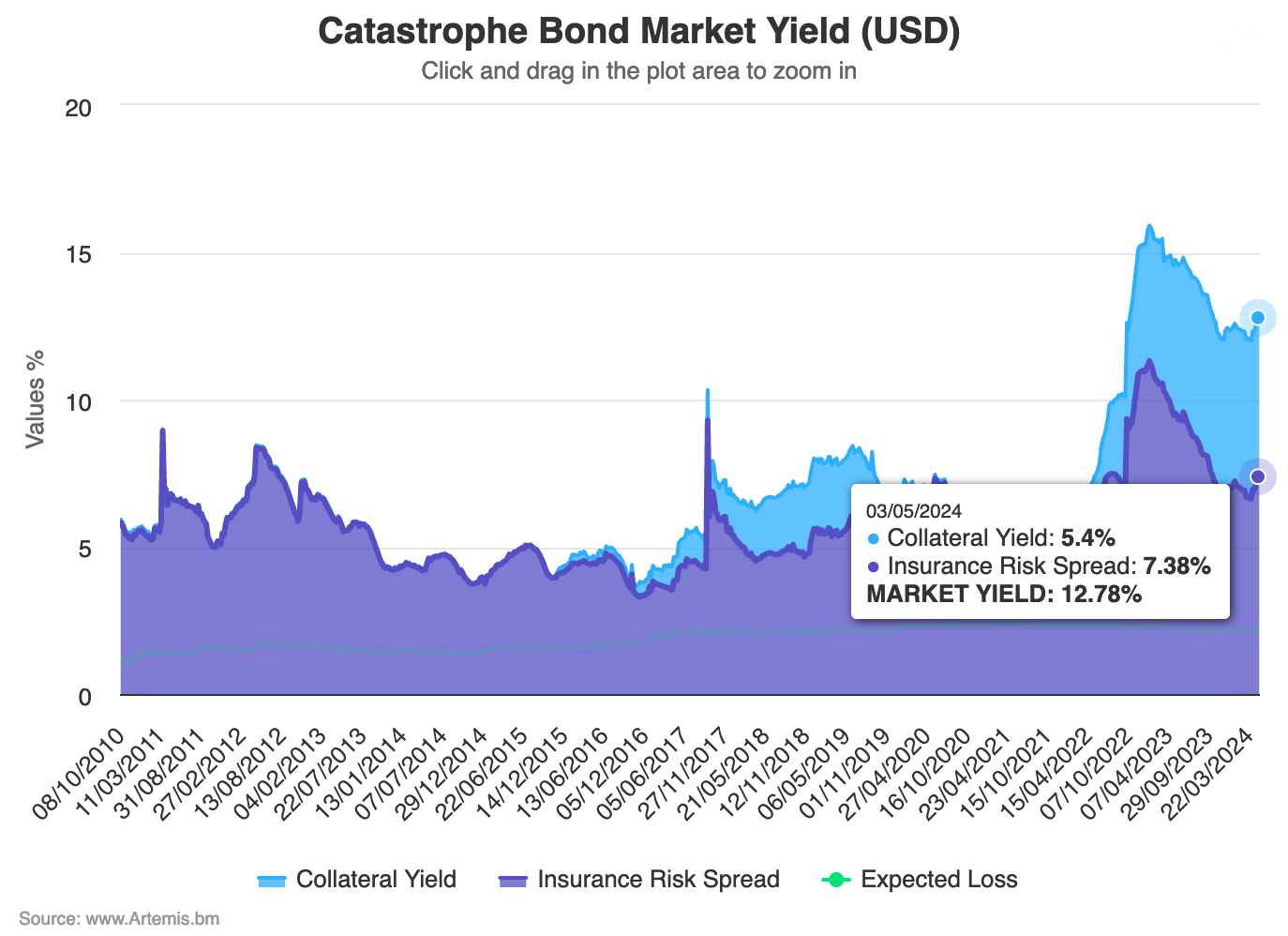

The whole yield of the disaster bond market in US {dollars} has risen by roughly 7% through the month of April, to succeed in a degree of 12.8%, with barely larger collateral yields plus an 11.5% restoration in insurance coverage threat spreads the important thing drivers.

You may analyse this in our chart that shows the yield of the disaster bond market over time.

On the finish of March 2024, the whole yield of the disaster bond market in US {dollars} had declined to 12%, with the insurance coverage threat unfold element dropping to six.62%.

Quick-forward only a few weeks and the whole yield has recovered by 7% to succeed in 12.8%, as of Might third, whereas the insurance coverage threat unfold element rose at a sooner tempo of 11.5% to succeed in 7.38%.

Analyse the yield of the disaster bond market and its constituent elements in Artemis’ chart (click on the picture beneath to entry an interactive model):

Cat bond market yields had peaked in early January this yr, when the whole yield of the cat bond market reached a file (for this information set) of 15.91%, pushed largely by a really excessive insurance coverage threat unfold element of 11.31%.

Insurance coverage threat spreads then steadily declined via the first-quarter of the yr, aligned with the unfold tightening seen throughout the secondary cat bond market and the decrease pricing that was evident in major points, pushed by supply-demand imbalance associated components.

However, April noticed a turnaround of types, because the market turned extra balanced and unfold widening turned the defacto pattern within the secondary marketplace for cat bonds.

Whereas there may be additionally some proof of a pricing ground having been reached for major cat bond points, particularly for combination and business loss index cat bond offers, in addition to for some perils comparable to Florida wind.

All of which has contributed to the rise in cat bond market yield via the month of April, one thing that implies a degree of stability has been achieved at or barely above the 12% cat bond market yield degree.

As we reported yesterday, latest cat bond unfold widening can be being partially attributed to the introduction of a brand new Atlantic hurricane mannequin, which has adjusted threat appetites and return necessities for some fund managers available in the market, we perceive.

The disaster bond market has develop into much more dynamic in recent times, with pricing and subsequently yields available in the market adjusting based mostly on provide of capital, demand for risk-linked investments, situations within the international capital markets, in addition to investor and supervisor notion of threat.

During the last 12 months or so, we’ve seen all 4 of those dynamics having an impact on the disaster bond market, driving a response in cat bond yields and this will ship funding and buying and selling alternatives for these capable of work with this cycle of provide, demand and pricing.

Analyse disaster bond market yields over time utilizing our new chart.