Foreign exchange merchants make the most of Fibonacci retracements to assist in figuring out doable key ranges of help and resistance. These ranges are used as tips for merchants seeking to enter or exit the market together with acceptable threat administration methods.

HOW TO CREATE A FIBONACCI RETRACEMENT ON A FOREX PAIR

Earlier than delving deeper into sensible examples, merchants have to have a primary view of the general market being analyzed (EUR/USD or USD/ZAR and many others.). This begins by figuring out the pattern; this may be lengthy, medium or short-term relying on buying and selling model. There are numerous strategies that can be utilized to establish the pattern similar to easy value motion, indicators like Shifting Averages (MA) , in addition to different strategies. The rationale why figuring out the pattern is necessary is as a result of the Fibonacci software itself doesn’t decide a pattern bias, fairly it identifies key help and resistance ranges.

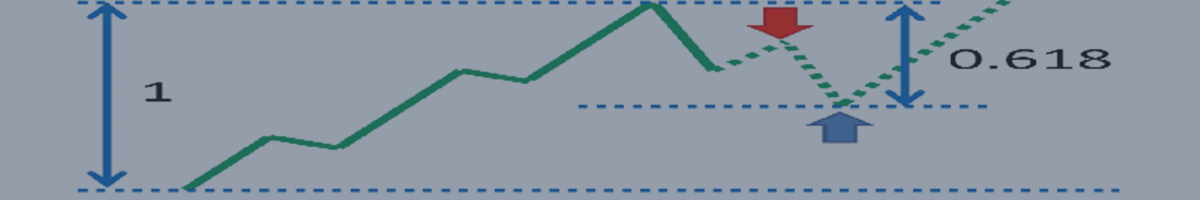

Implementing the Fibonacci retracement requires figuring out a big transfer both up/down on the foreign exchange value chart. This can produce key ranges utilizing Fibonacci metrics. The dueling nature of a foreign exchange pair has the tendency for imply reversion, which might produce main strikes from which Fibonacci retracements will be drawn.

The important thing ranges to look out for are the 38.2% and 61.8% respectively. The 50% stage just isn’t technically a Fibonacci stage however is usually included in charting packages and considered an necessary threshold. This stage merely marks half the market transfer between the preliminary excessive and low or vice versa. The chart beneath exhibits a easy implementation of the Fibonacci retracement on a GBP/ZAR day by day chart. Highlighted in black are the respective low to excessive factors that are used to plot the Fibonacci ranges.

GBP/ZAR day by day chart – uptrend:

Merchants may additionally make the most of the Fibonacci retracement from a excessive to low value stage as expressed on the USD/SGD chart beneath.

USD/SGD day by day chart – downtrend:

As soon as the Fibonacci retracement is drawn, merchants can use these value ranges for doable entry and exit alerts. The USD/CAD instance beneath exhibits how value motion tends to revert to the varied Fibonacci ranges. The blue rectangle highlights the world between the 61.8% and 38.2% Fibonacci ranges. It’s evident that value respects these two key help and resistance factors. Merchants could look to enter into quick positions on the 61.8% – because of the previous downward pattern, with preliminary help coming from the 38.2% stage.

You will need to be aware that the Fibonacci factors shouldn’t be seen as concrete ranges however fairly tips or reference factors. Value is not going to all the time commerce at these precise ranges. It is not uncommon to see value simply falling quick or pushing handed a stage which might frustrate merchants who take a look at precise ranges. As regards to cease and restrict orders, merchants ought to give themselves some leeway for potential value fluctuations across the Fibonacci stage. The chart beneath exhibits an instance of this above the 23.6% stage (yellow) the place bulls are seen pushing value up however shortly reverting again down beneath the 23.6% stage.

USD/CAD day by day chart:

That is probably the most simplistic type of the Fibonacci retracement inside foreign exchange markets. The flexibility of the Fibonacci retracement perform implies that it isn’t restricted to 1 time-frame as seen above. A extra difficult method includes a number of Fibonacci retracements throughout completely different time frames. Instituting a number of time-frame evaluation can permit for a number of Fibonacci retracements drawn from main strikes. The subsequent article within the Fibonacci collection will go into extra depth with and sensible examples to indicate how precisely merchants can implement this technique.

FIBONACCI RETRACEMENTS TO HELP TO SEE THE BIGGER PICTURE

Foreign exchange merchants usually make the error of relying solely on Fibonacci ranges to take positions available in the market however this may be detrimental as this could make them too one dimensional. Further help from different indicators, chart patterns, candlestick patterns and fundamentals are important to formulate a greater total technique; and in the end a well-informed commerce resolution. The Fibonacci will be a particularly highly effective software in foreign currency trading so absolutely understanding its foundations will be helpful to any dealer seeking to implement the software inside their buying and selling technique.

Be taught extra about Fibonacci and different buying and selling associated matters by subscribing to our channel.