This text compares my inventory portfolio with an equal funding in a Nifty index fund and the Nifty 100 Low Volatility 30 TR index. We publish this comparability every month. Earlier than we start, new readers want to understand the context of those investments.

I began direct fairness investing solely after attaining a snug degree of monetary independence and making certain my son’s future portfolio within reason safe. On the time of writing, its worth is about 11.86% of my fairness MF retirement portfolio and seven.10% of my complete retirement portfolio.

Due to this fact, I invested with out the concern of efficiency. There isn’t any experimentation or analysis within the inventory choice technique. That’s typically a waste of time and, subsequently, a waste of true wealth – time. I proceed to spend money on the identical manner. Loads of cash may be made in low-volatile, strong blue-chip shares.

Warning: No a part of this text ought to be handled as funding recommendation. I began investing in shares after my goal-based investing was in place. Readers should respect that I began investing in shares after hitting the edge of monetary independence. So there isn’t a stress for me after I choose shares the way in which talked about right here. Please do your analysis and purchase as per your circumstances.

My objective is to purchase shares with virtually zero analysis. I additionally proceed to spend money on mutual funds as ordinary.

I’ve bought mutual funds each month, no matter market ranges, and I shall attempt to repeat this uninteresting technique for direct fairness if I’ve the cash. Additionally, see Fourteen Years of Mutual Fund Investing: My Journey and Classes Discovered.

Time is not only cash; Time is unquantifiable cash. Time wasted in inventory or mutual fund evaluation, the proper time to take a position, and many others., is an unquantifiable loss. So, I purpose to purchase a fund or inventory inside a minute.

There’s zero talent concerned in any facet of my portfolio. I compensate for the lack of awareness with self-discipline. Randomness (aka luck) performs an enormous position within the return numbers beneath.

After evaluating the efficiency of low-volatility indices, I acquired the boldness to spend money on shares. I instructed myself I’d not do any inventory evaluation or analysis. A fast test of firm well being, a short volatility overview, and purchase. If I can not purchase a inventory inside a couple of minutes, I’m losing money and time (in that order).

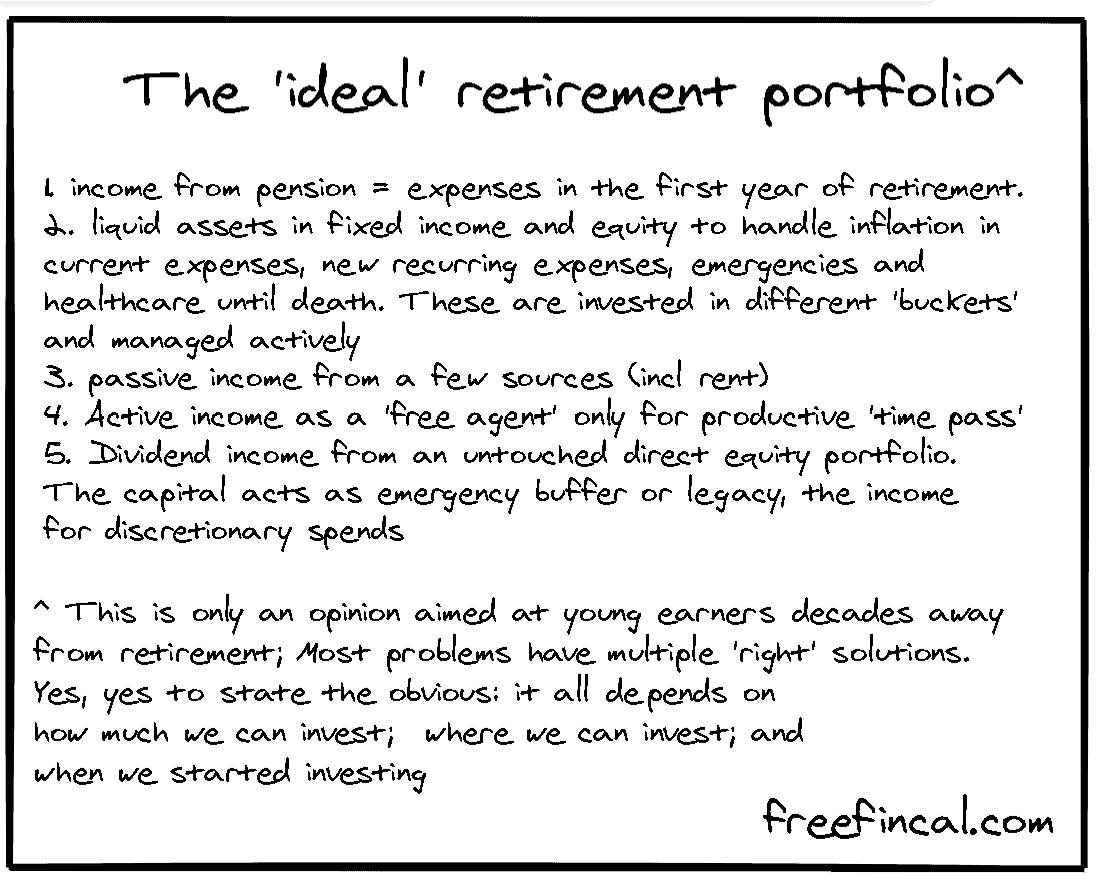

The best way I see it, the inventory portfolio is a part of my retirement portfolio basket as a dividend supply. It may function an emergency fund as a final resort. Possibly I’ll discover one other use for It in future.

In FY 2020-21, this portfolio’s complete annual dividend revenue (pre-tax) was about 30% of my present month-to-month bills. In FY 2021-2022, it elevated to about 56%. In FY 2022-23, it grew to become about 70%. In FY 2023-2024, about 88% (up to date to March thirty first). The following objective is to obtain one month’s bills as a complete quarterly dividend (post-tax!). I don’t consciously reinvest dividends. Youthful individuals ought to. It issues little so long as the general funding made every month retains rising wholesome: How ten years of monitoring investments modified my life.

This inventory portfolio is a part of my general retirement portfolio. I’m striving to construct the very best retirement portfolio. Additionally, see construct a second revenue supply that can final a lifetime.

Inventory selecting technique

- Select shares with little or no analysis or evaluation.

- Select low unstable shares with sound monetary well being (low debt min requirement)

- Select shares that commerce near their all-time highs (approx momentum indicator). See, for instance, A listing of shares which have traded near their “all-time excessive:

- Don’t be afraid to select costly shares at absolute worth and valuation. Word: Worth investing might sound clever and engaging, however it’s riskier. I neither have the age to tackle such a threat nor the qualitative insights to select shares that the market has shunned however might be found sooner somewhat than later. To understand the danger related to worth investing and why it’s extra qualitative than quantitative, see this evaluation: Is it time to exit ICICI Worth Discovery & Quantum Lengthy Time period Fairness?

- When doubtful, ask your spouse when she is about to go to sleep within the afternoon.

- Don’t concern dividends (or dividend taxation).

- What issues primarily is corporate well being. Whether or not it’s a dividend payer or not is incidental. It is senseless to say no to an organization as a result of it pays enormous dividends! It is senseless to promote a inventory as a result of it has elevated dividend payout.

- All inventory traders over ten years will obtain dividends, no matter whether or not they prefer it. There isn’t any alternative, in contrast to mutual funds.

- Dividends should not “further” concerning returns/efficiency however signify actual revenue. It may function a supply of revenue for an older investor, Constructing the best retirement portfolio. Youthful traders won’t ever perceive this, and that’s tremendous.

- Peaceable sleep is the perfect type of realised positive factors, therefore the significance of low volatility and cheap momentum to enterprise well being (not all shares in my portfolio will test all these packing containers).

- That is the archive of earlier portfolio updates.

Associated movies: purchase your first inventory with out breaking your head

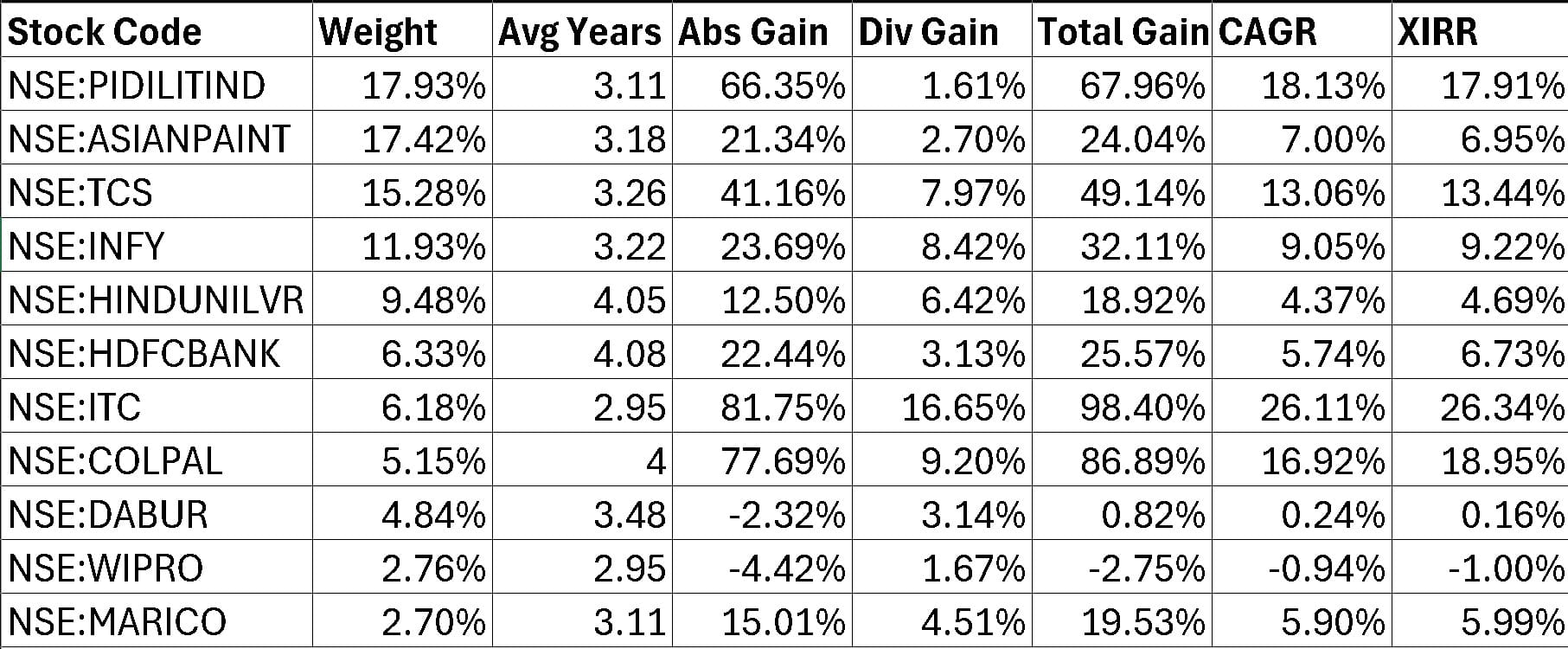

Inventory Portfolio Evaluation

- The debt-to-equity ratio of the portfolio is 55.63% (vs. 81.2% of the board market, in keeping with Simplywall).st – we assume that is just like Nifty or Sensex)

- Dividend yield: 1.4% vs 1.2% broad market

- Dividend development price: 9.6% vs 12.4% broad market

- Dividend payout ratio: 53% of web revenue.

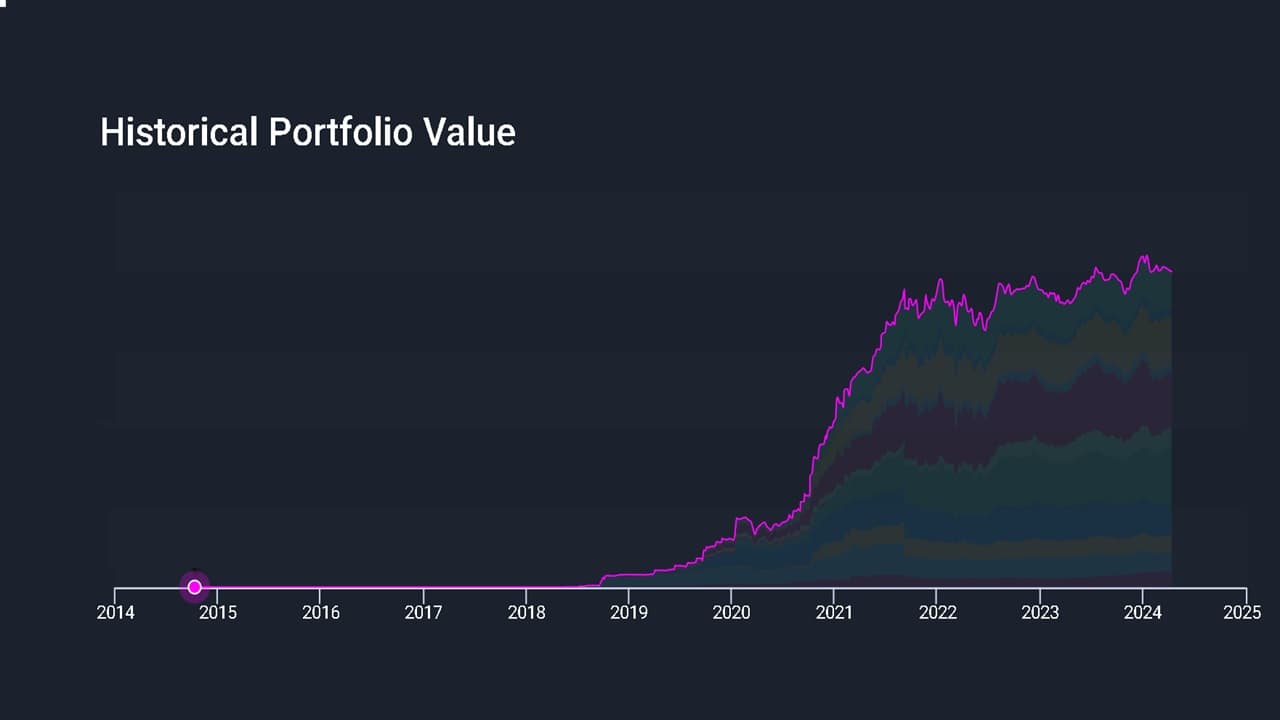

That is the portfolio evolution.

As of April twelfth 2024, all outcomes are computed utilizing our Google Sheets-based inventory and MF portfolio trackers.

Please be aware: (1) Though investments began in 2014, many of the cash invested is just from July 2020. So, the portfolio remains to be too younger.

(2) I didn’t make investments between Nov 2021 and April 2022 as a consequence of different priorities. On the time of writing, the final funding was made in October 2022. The portfolio weights have drifted naturally. Once I can make investments, I attempt to chase momentum inside the portfolio and spend money on shares which have gained essentially the most since I began investing in them.

- Dividend Return = Whole Dividends divided by Whole Funding

- Capital Achieve (CG) Returns = Whole CG divided by Whole Funding

- Whole Return = Dividend Return + CG Return.

- CAGR = ( 1 + Whole Return ) ^ ( 1 / Avg. Years) – 1

- The typical funding period = 3.43 years for your complete portfolio. That is the common of all buy funding tenures weighted by the investments.

- CAGR is computed provided that the common years = > 1. XIRR ought to be taken critically provided that the common variety of years is => 1.

- All returns are earlier than tax.

- The portfolio is in contrast with equivalent investments into UTI Nifty 50 Index Fund (direct plan!)

Many individuals and portals mistakenly deal with dividends as money payouts whereas calculating XIRR. This isn’t the universally accepted educational and regulatory conference. Solely purchases and redemptions by the investor ought to be used within the XIRR calculation. Dividends ought to be handled appropriately as reinvested (a rule additionally mandated by SEBI), and different company actions ought to be handled appropriately. The freefincal inventory tracker aligns with SEBI laws for all company actions (dividends, splits, buybacks, and many others.)

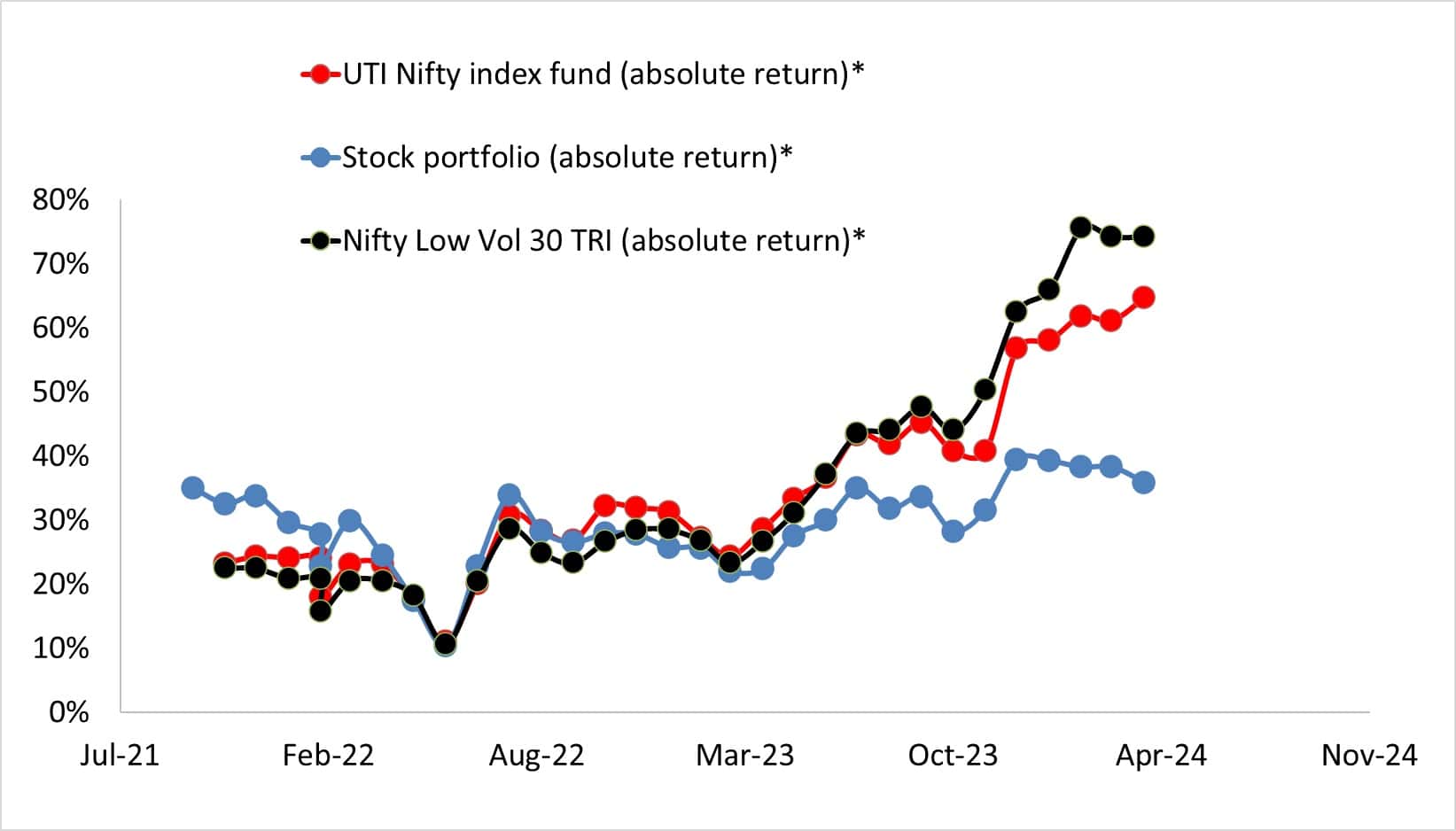

Comparability with benchmark

The NIfty 100 low vol 30 is a greater benchmark for this portfolio. Nevertheless, we are able to solely evaluate it with the index, not the ETF (from ICIC), which was launched solely in 2017.

- Inventory portfolio (absolute return)* 35.87%

- UTI Nifty index fund (absolute return)* 64.71%

- Nifty Low Vol 30 TRI (absolute return)* 74.25%

- Inventory portfolio CAGR 9.36%

- UTI Nifty Index fund CAGR 15.68%

- Nifty Low Vol 30 TRI CAGR 17.60%

- Inventory Portfolio XIRR (incl all company actions like dividends and splits) 9.99%

- UTI Nifty Index fund XIRR 17.48%

- Nifty Low Vol 30 TRI XIRR 19.32%

* Whole return and CGAR embrace liquidated holdings (see month-to-month replace archives for particulars).

In response to Tikertape, the portfolio has no crimson flags, with a beta of 0.58. This implies the portfolio is 42% much less unstable than an index just like the Nifty or Sensex. The inventory portfolio has underperformed for the previous a number of months. This doesn’t hassle me an excessive amount of for 3 causes: (1) The inventory portfolio is a small portion of my retirement corpus, (2) I deal with this as a future revenue supply and (3) a minimum of as of now, the return unfold is decrease than the benchmarks (as seen above), and that’s one thing I worth.

I’ve had enjoyable constructing this with no effort and can proceed. Please do your analysis and make investments.

Do share this text with your mates utilizing the buttons beneath.

🔥Get pleasure from huge reductions on our programs, robo-advisory instrument and unique investor circle! 🔥& be a part of our neighborhood of 5000+ customers!

Use our Robo-advisory Instrument for a start-to-finish monetary plan! ⇐ Greater than 1,000 traders and advisors use this!

New Instrument! => Monitor your mutual funds and inventory investments with this Google Sheet!

We additionally publish month-to-month fairness mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility inventory screeners.

Podcast: Let’s Get RICH With PATTU! Each single Indian CAN develop their wealth!

You possibly can watch podcast episodes on the OfSpin Media Associates YouTube Channel.

🔥Now Watch Let’s Get Wealthy With Pattu தமிழில் (in Tamil)! 🔥

- Do you’ve a remark concerning the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our e-newsletter utilizing the shape beneath.

- Hit ‘reply’ to any e mail from us! We don’t provide customized funding recommendation. We will write an in depth article with out mentioning your identify when you’ve got a generic query.

Be a part of over 32,000 readers and get free cash administration options delivered to your inbox! Subscribe to get posts by way of e mail!

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Study to handle your portfolio like a professional to realize your objectives no matter market circumstances! ⇐ Greater than 3,000 traders and advisors are a part of our unique neighborhood! Get readability on learn how to plan on your objectives and obtain the mandatory corpus regardless of the market situation is!! Watch the primary lecture at no cost! One-time cost! No recurring charges! Life-long entry to movies! Cut back concern, uncertainty and doubt whereas investing! Discover ways to plan on your objectives earlier than and after retirement with confidence.

Our new course! Enhance your revenue by getting individuals to pay on your abilities! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Discover ways to get individuals to pay on your abilities! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers by way of on-line visibility or a salaried individual wanting a aspect revenue or passive revenue, we are going to present you learn how to obtain this by showcasing your abilities and constructing a neighborhood that trusts and pays you! (watch 1st lecture at no cost). One-time cost! No recurring charges! Life-long entry to movies!

Our new e-book for teenagers: “Chinchu Will get a Superpower!” is now accessible!

Most investor issues may be traced to an absence of knowledgeable decision-making. We made dangerous selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this e-book about? As mother and father, what wouldn’t it be if we needed to groom one means in our kids that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Determination Making. So, on this e-book, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his mother and father plan for it, in addition to educating him a number of key concepts of decision-making and cash administration, is the narrative. What readers say!

Should-read e-book even for adults! That is one thing that each mother or father ought to educate their children proper from their younger age. The significance of cash administration and resolution making primarily based on their needs and desires. Very properly written in easy phrases. – Arun.

Purchase the e-book: Chinchu will get a superpower on your baby!

revenue from content material writing: Our new e-book is for these keen on getting aspect revenue by way of content material writing. It’s accessible at a 50% low cost for Rs. 500 solely!

Do you wish to test if the market is overvalued or undervalued? Use our market valuation instrument (it’s going to work with any index!), or get the Tactical Purchase/Promote timing instrument!

We publish month-to-month mutual fund screeners and momentum, low-volatility inventory screeners.

About freefincal & its content material coverage. Freefincal is a Information Media Group devoted to offering unique evaluation, experiences, critiques and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made might be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out information. All opinions might be inferences backed by verifiable, reproducible proof/information. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Aim-Primarily based Investing

Revealed by CNBC TV18, this e-book is supposed that will help you ask the proper questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Revealed by CNBC TV18, this e-book is supposed that will help you ask the proper questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Gamechanger: Neglect Startups, Be a part of Company & Nonetheless Stay the Wealthy Life You Need

This e-book is supposed for younger earners to get their fundamentals proper from day one! It’ll additionally assist you to journey to unique locations at a low value! Get it or present it to a younger earner.

This e-book is supposed for younger earners to get their fundamentals proper from day one! It’ll additionally assist you to journey to unique locations at a low value! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)

That is an in-depth dive into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)