In the case of investing, choosing the right buying and selling app could make an enormous distinction. Not solely will a clean person expertise with all of the options you search streamline your funding course of, but additionally minimal charges might help take advantage of your potential earnings.

Some standard funding apps at present embody Robinhood, moomoo, and Webull. However the fitting one varies primarily based in your preferences and wishes.

In partnership with moomoo, let’s discover every to present you a greater concept of which choice is perhaps the most effective match for you.

For those who’re interested in getting began with moomoo, open and fund an account right here to earn a “Magnificent 7” fractional share bundle or 1.5% Money Reward match ($300 max) on Transfers. Phrases & Circumstances apply. >>

Robinhood vs moomoo vs Webull

Every of those investing platforms permits you to put money into shares, ETFs, and even crypto by means of ETFs. After all, every comes with the danger related to investing your funds available in the market. However in case you are excited about constructing an funding portfolio, one among these three platforms might be the fitting match.

We’re going to check every platform on options, charges, buyer expertise, and extra. Let’s get began.

moomoo

moomoo is a well-liked buying and selling app that permits you to put money into inventory, ETFs, and choices. They even will let you simply put money into the Chinese language and Hong Kong inventory exchanges.

What units moomoo aside is their give attention to buying and selling. Each inventory and choice buying and selling are the important thing options of the app.

High Options

- Excessive money sweep APY: Moomoo at the moment gives a 5.1% APY by means of their money sweep Program.

- Free entry to real-time knowledge: You possibly can faucet into knowledge about real-time bids and asks for a big selection of shares, with out paying for the data. Different perks embody details about upcoming IPOs that will help you plan forward.

- Fractional shares: You should buy fractional shares by means of moomoo’s platform.

- Customized inventory screener: If you’re excited about discovering a inventory that meets your particular parameters, you should utilize this instrument to filter primarily based on many indicators and dozens of filters to discover a inventory that will fit your funding objectives.

- No choices contract charges: You possibly can skip contract charges on fairness choices. whereas index choices might be topic to a $0.50 per contract price. Different charges could apply. For more information, go to moomoo.com/us/pricing

Charges

moomoo gives commission-free investing for U.S. shares and ETFs. However you’ll face charges if you happen to commerce by means of the Hong Kong inventory market.

Buyer Expertise

moomoo has the least variety of Trustpilot critiques of the three apps we’re evaluating, at round 50. It has a score of 2.9 out of 5 stars as of March 2024. moomoo has additionally earned at 4.6 out of 5 star rankings within the Apple App Retailer and Google Play Retailer, with over 20,000 reviewers.

All in all, the numbers recommend that moomoo customers are having fun with a greater expertise.

App Expertise

Right here’s what the moomoo app seems like once you’re organising a commerce:

Pictures supplied usually are not present and any securities are proven for illustrative functions solely and isn’t a suggestion.

Robinhood

Robinhood was the primary commission-free investing app. It was the primary firm to supply free buying and selling, and it has made it a spotlight to maintain investing so simple as potential.

High Options

- Excessive money APY reserved for Robinhood Gold: You possibly can earn 1.5% APY on uninvested money. However in case you are a Robinhood Gold member, you may earn 5% in your uninvested money.

- Robinhood Retirement: You possibly can earn as much as a 1% match for each greenback you contribute towards retirement. However it is a limited-time provide for Robinhood Gold members.

- Fractional shares: The Robinhood platform helps fractional shares.

Charges

Robinhood gives commission-free investing for shares, ETFs, and choices. The corporate earns cash by means of the subscription-based Robinhood Gold account, which comes with entry to issues like margin buying and selling. That $5 monthly subscription can add up, particularly if you happen to don’t have some huge cash invested.

Buyer Expertise

It’s essential to level out that Robinhood has seen a whole lot of adverse press. It even needed to pay a $70 million high-quality to the FINRA. The adverse press is accompanied by a 1.3 out of 5-star score on Trustpilot, with over 3,500 reviewers. Thousands and thousands have reviewed the corporate on the Apple App Retailer, the place it earned 4.2 out of 5 stars.

App Expertise

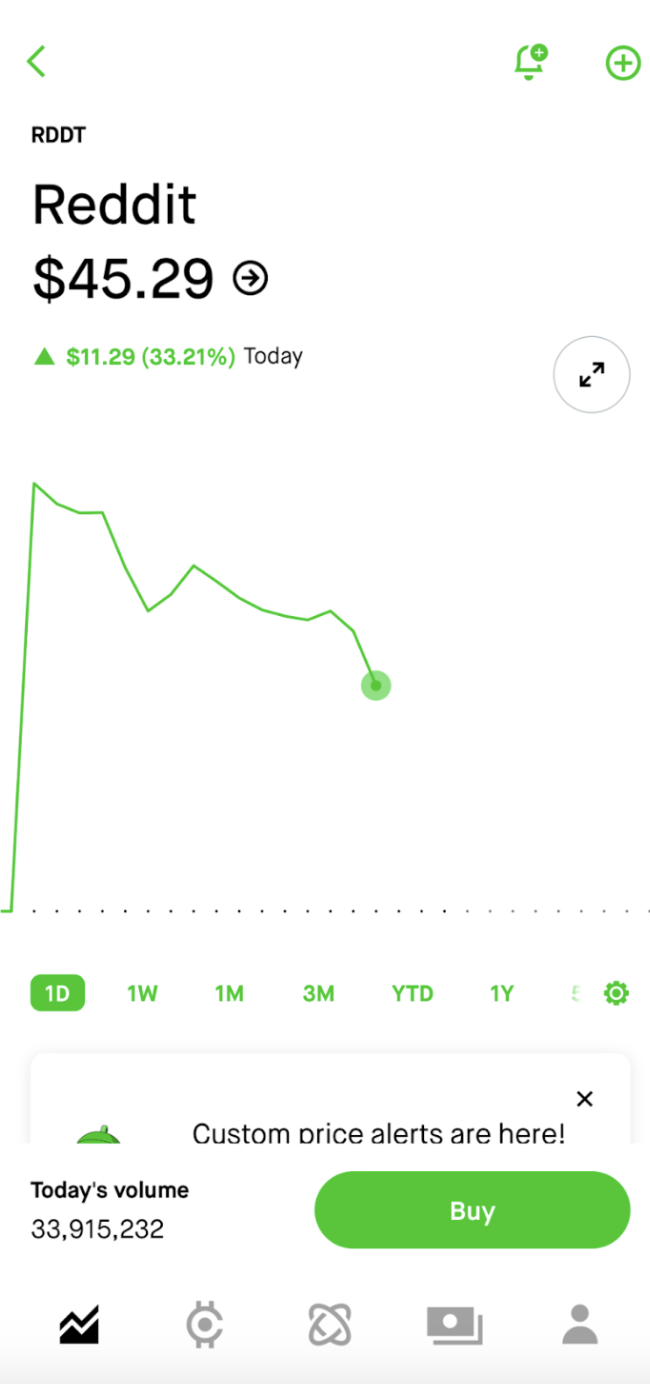

Robinhood is thought for having the cleanest app interface. That is what the expertise seems like:

Pictures supplied usually are not present and any securities are proven for illustrative functions solely and isn’t a suggestion.

For extra data, take a look at our Robinhood assessment.

Webull

Webull is one other app that has targeted on inventory buying and selling. They have been one of many first cellular apps so as to add a whole lot of charts and analysis into the investing course of.

High Options

Webull’s highlighted options:

- Buying and selling assets: Webull customers can faucet into over 50 indicators and 20 charting instruments that will help you handle your portfolio. With a strong quantity of data at your fingertips, you may make extra knowledgeable buying and selling choices.

- Fractional shares: Webull helps fractional shares on its platform.

- No choices contract charges: There are not any contract charges for buying and selling inventory and ETF choices on Webull.

Charges

Webull additionally gives commission-free trades for shares. However you’ll pay a 1% level unfold on each side of a crypto commerce.

Buyer Expertise

Webull has a 1.5 out of 5 star Trustpilot score, with lower than 200 reviewers. However app critiques are a lot greater. It earned 4.3 out of 5 stars within the Google Play Retailer, with over 188,000 critiques. And 4.7 out of 5 stars within the Apple App Retailer, with over 297,000 critiques.

App Expertise

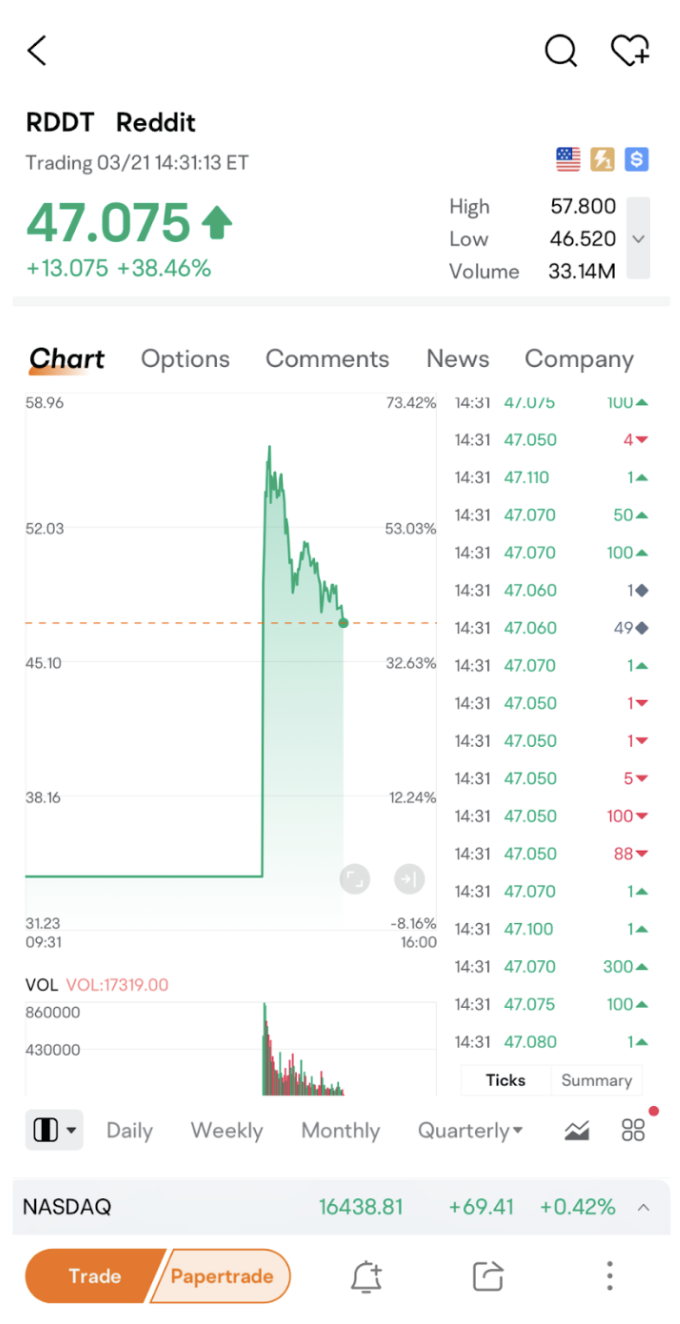

Here’s what the app expertise on Webull is like:

Pictures supplied usually are not present and any securities are proven for illustrative functions solely and isn’t a suggestion.

Be taught extra in our Webull assessment.

Robinhood vs moomoo vs Webull: Which Is Finest For You?

Robinhood’s easy platform might be the fitting match for freshmen. Though you will have entry to some market data, it’s not as strong as what moomoo or Webull has to supply.

Moomoo shines by providing a 5.1% APY money sweep and entry to the Hong Kong market. Moomoo customers can faucet into an intensive array of free assets to remain on high of their portfolio and make trades with reasonably priced charges. alongside the best way.

The Backside Line

Robinhood, moomoo, and Webull every have professionals and cons. As an investor, you’ll need to resolve which choice most closely fits your wants.

For those who’re unsure the place to start out, think about giving moomoo a shot. You’ll at the very least earn 5.1% APY in your uninvested money, and may get a “Magazine 7” fractional share bundle for deposits or a 1.5% Money Reward match ($300 max) on transfers. Phrases & Circumstances apply.

Choices buying and selling is dangerous and never applicable for everybody. Learn the Choices Disclosure Doc (j.us.moomoo.com/00xBBz) earlier than buying and selling. Choices are advanced and you could shortly lose your entire funding. Supporting docs for any claims might be furnished upon request.

Moomoo is a monetary data and buying and selling

app supplied by Moomoo Applied sciences Inc. Securities are supplied by means of Moomoo Monetary Inc., Member FINRA/SIPC. The creator is a paid influencer and isn’t affiliated with Moomoo Monetary Inc. (MFI), Moomoo Applied sciences Inc. (MTI) or some other affiliate of them. Any feedback or opinions supplied by the influencer are their very own and never essentially the views of moomoo. Moomoo and its associates don’t endorse any buying and selling methods which may be mentioned or promoted herein and usually are not accountable for any companies supplied by the influencer. This commercial is for informational and academic functions solely and isn’t funding recommendation or a suggestion to interact in any funding or monetary technique. Investing includes danger and the potential to lose principal.

Funding and monetary choices ought to all the time be made primarily based in your particular monetary wants, targets, objectives, time horizon and danger tolerance. Any illustrations, eventualities, or particular securities referenced herein are strictly for academic and illustrative functions and isn’t a suggestion. Previous efficiency doesn’t assure future outcomes.