Within the final week, because the Federal authorities comes in the direction of subsequent Tuesday’s annual fiscal assertion (aka ‘The Price range’ though we don’t use that terminology round right here, can we?) and the State Authorities’s are progressively delivering their very own Price range Statements (they being financially constrained) we now have witnessed the absurdity of the system of public funds that pretends the Federal authorities is a giant family and that by some means financial coverage is the best technique to take care of an inflation that’s sourced in provide aspect constraints. Earlier this week, the Victorian authorities launched a reasonably stunning fiscal assertion, which lower expenditure applications in lots of key areas corresponding to well being care (whereas the pandemic continues to be killing many individuals), public training, important public infrastructure upkeep and upgrades, and extra. Why? As a result of it constructed up a relatively massive inventory of debt in the course of the early years of the pandemic and is now in political jeopardy as a result of the state debt is being weaponised by the conservatives who declare the federal government goes broke. Related austerity agendas are being pursued by different state and territory governments though Victoria leads the way in which as a result of it offered extra pandemic assist to offset the injury that the in depth restrictions brought about. In the meantime, the federal authorities is boasting that it’s heading in the direction of its second consecutive surplus, as unemployment rises, hours of labor fall, and the planet requires huge funding to attenuate local weather change. The insanity compounds after we realise that round 85 per cent of all state and federal debt that was issued between March 2020 and July 2022 was bought by the Reserve Financial institution of Australia – that’s, successfully, by the federal authorities itself. If residents actually understood the implications of that they’d by no means comply with the swingeing cutbacks in public expenditure and the consumer pays tax hikes and so on, which were justified by an attraction to the debt construct up. Its simply insanity.

The next graph exhibits the RBA holdings in whole federal authorities debt since January 2017 to April 2024.

On the peak (July 2022), the RBA held 32.69 per cent of whole excellent federal debt.

As at April 2024 it holds 28 per cent.

Throughout the first few years of the pandemic, the RBA purchased a lot of the federal and state/territory debt that was issued.

In impact, the federal authorities shopping for its personal debt up in addition to hoovering up the debt issued by the subsequent stage of presidency down.

Thinks about what meaning.

The RBA simply typed numbers into financial institution accounts and took possession of the debt devices that it purchased within the secondary bond market (after the governments had issued the debt within the main market).

On the federal stage, this was only a right-left pocket type of deal.

The correct pocket points the debt and pays the yield to the left pocket.

The left pocket then pays the yield again to the fitting pocket (within the type of the dividend funds the RBA gives to Treasury).

A charade.

Within the case of the state/territory governments, the preparations have seen a big switch of funds from the states to the federal authorities.

Why?

The RBA buys the state authorities debt.

The states and territories must service that debt by paying the RBA the yield and the principal on maturity.

The RBA then contains these funds in its dividend cost to the Treasury.

The states and territories are pressured by media stress then to chop again on important spending applications due to its excellent debt however not one of the media stories word that the RBA holds a big quantity of that debt.

The Sky Information headline yesterday was ‘Lifeless set broke’: Sky Information host slams the State of Victoria’s debt’ and wheeled out a commentator as an ‘knowledgeable’ who simply lied to the general public.

It adopted up with video content material ‘Victoria’s debt from ‘decade’ of Labor’s ‘catastrophically unhealthy’ financial administration’

The Proper-wing Melbourne Solar newspaper carried headlines: ‘Dire Debt Loop’.

One of many large TV stations carried the story “Main initiatives scrapped in brutal Victorian state funds”.

And so it went, the media shops had been having a area day speaking up some confected sense of disaster and calling for even harsher fiscal cuts than the Victorian Labor authorities truly introduced.

As a matter of reality, the Victorian Opposition conservatives are a complete rabble – dysfunctional, incompetent and with none deserves that will counsel they’re prepared to manipulate the state when the subsequent election is held.

But all of the ‘debt’ discuss is offering them with a surge within the polls.

And spare the thought in the event that they had been truly elected.

Take a second.

Think about if somebody within the RBA workplaces accidently typed some zeros within the accounting system in opposition to the RBA holdings of federal authorities and state and territory authorities debt.

In different phrases, simply wiped the massive RBA holdings off.

Practically a 3rd of the Federal authorities debt would disappear, whereas a big slice of the semis debt (state and territories) would vanish.

Would the media nonetheless be capable to declare there was a significant fiscal disaster in any respect ranges of presidency?

Unlikely, the graphs that they rigorously manipulate the vertical scales to point out authorities debt going by the roof would appear to be Mt Everest.

Their lurid headlines would look fairly silly.

And ask your self whether or not your world would look any totally different the day after the RBA officer typed within the zeros.

Not a single particular person would see any distinction.

But, when the governments then begin slicing important expenditure applications, together with delaying funding in abating local weather threat and enhancing the hospital system that’s failing (as I famous on Monday), our worlds do change considerably – for the more serious.

But all that could possibly be averted if the RBA simply wiped off the debt.

No unfavorable penalties would circulation from such an motion.

It’s insanity for them to faux in any other case.

However the insanity doesn’t finish there.

On Tuesday, the RBA determined to maintain rates of interest on maintain however the governor as is her wont paraded earlier than the media threatening powerful motion.

That is within the context of the inflation price persevering with to say no and posing no menace of acceleration.

Why did the inflation price fall so quickly since September 2022?

As a result of the components that led to the inflationary pressures have abated – pandemic restrictions and illness, Putin, OPEC+.

The 11 RBA price hikes since Could 2022 haven’t been crucial and have brought about an enormous redistribution of earnings from the poorer mortgage holders to the wealtheir monetary asset holders.

That alone is disgraceful.

However as Trendy Financial Principle (MMT) economists have duly famous, the rate of interest hikes have truly began driving the inflationary pressures themselves.

In Australia, the behaviour of the rental part within the CPI, which is now answerable for the general inflation price falling extra slowly than it’d given the opposite fundamentals, is an instance of this RBA impact.

The speed hikes add to the burden of the landlords, who reap the benefits of lax laws concerning the rental market and gouge the tenants.

One simply has to check Japan with right here.

In Japan the inflation price is now a lot decrease although they confronted the identical provide constraints as any nation.

And the Financial institution of Japan didn’t enhance rates of interest in the course of the inflation surge.

It tells us one thing.

Additional, subsequent week the Federal authorities will ship its fiscal assertion.

One other fiscal surplus is predicted on the again of an enormous rise in tax income pushed by so-called bracket creep.

In different phrases, the federal authorities is screwing wage and wage earners relentlessly and pretending that the surpluses are the results of accountable fiscal administration.

In the previous few days, the mainstream economists who usually are platformed within the nationwide media have been calling on the federal authorities to chop spending and enhance taxes to push the excess in even bigger numbers.

Apparently that is to assist the RBA in its inflation combat.

But, all of the financial information is suggesting that the economic system is on the precipice of a recession.

Right here is the month-to-month hours labored graph as much as March 2024.

It doesn’t look wholesome and we at the moment are observing the unemployment price beginning to rise.

After all, the RBA needs the unemployment price to rise so long as not one of the high officers don’t be part of the dole queue.

It is because they declare the NAIRU (the unemployment price purported to be affiliate with secure inflation) is above the present price of unemployment.

However I’ve identified earlier than, their logic is absurd.

The obtrusive inconsistency within the RBA’s narrative – notably the brand new governor’s speeches main as much as taking the place and since is the justification for rate of interest rises based mostly on the NAIRU estimate of the RBA which was 4.5 per cent final June then mysteriously dropped to 4.25 per cent extra just lately.

One of many issues with the New Keynesian strategy is its glued-down insistence that the so-called Non-Accelerating-Inflation-Fee-of-Unemployment (NAIRU) ought to information financial coverage.

The mainstream textbook rubbish which says that if the unemployment price is beneath the NAIRU then inflation accelerates, and, if the unemployment price is above the NAIRU, then inflation will decline.

The RBA at the moment claims they needed to hike charges as a result of the unemployment price of round 3.7 to three.9 per cent was beneath their NAIRU estimate.

I word the NAIRU is unobservable however estimated by econometric strategies and the sampling errors utilizing generate vast confidence intervals – which make the idea unimaginable to make use of for correct coverage making.

However these characters persist.

In Australia’s case during the last 2 years, the state of affairs is fairly clear.

The unemployment price has been very secure over the previous few 12 months or so, fluctuating inside a slim band, however the inflation price has been falling since September 2022.

Which signifies that logically, the NAIRU couldn’t be above the present unemployment price and should be beneath it.

Which signifies that the RBA’s insistence on placing 140,000 additional employees onto the unemployment scrap heap has no basis even within the theoretical construction they imagine in.

Different information corresponding to retail gross sales, enterprise bankruptcies and so on – which all inform us in regards to the state of the financial cycle are wanting poor.

Conclusion

At a time when inflation is falling fairly steadily and the economic system is tipping in the direction of recession, it’s lunacy to be working fiscal surpluses.

However that’s the place we’re at.

I’m positive enlightened beings from different planets are wanting down on this mess and considering how silly all of us are for tolerating such idiocy.

Advance orders for my new e-book at the moment are obtainable

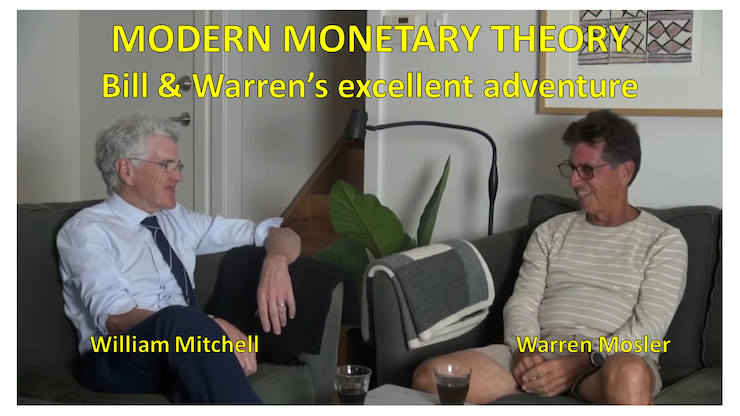

I’m within the closing levels of finishing my new e-book, which is co-authored by Warren Mosler.

The e-book will likely be titled: Trendy Financial Principle: Invoice and Warren’s Wonderful Journey.

The outline of the contents is:

On this e-book, William Mitchell and Warren Mosler, unique proponents of what’s come to be often known as Trendy Financial Principle (MMT), focus on their views about how MMT has advanced during the last 30 years,

In a pleasant, entertaining, and informative means, Invoice and Warren reminisce about how, from vastly totally different backgrounds, they got here collectively to develop MMT. They take into account the historical past and personalities of the MMT neighborhood, together with anecdotal discussions of assorted teachers who took up MMT and who’ve gone off in their very own instructions that depart from MMT’s core logic.

A really a lot wanted e-book that gives the reader with a basic understanding of the unique logic behind ‘The MMT Cash Story’ together with the function of coercive taxation, the supply of unemployment, the supply of the worth stage, and the crucial of the Job Assure because the essence of a progressive society – the essence of Invoice and Warren’s glorious journey.

The introduction is written by British educational Phil Armstrong.

You could find extra details about the e-book from the publishers web page – HERE.

It will likely be printed on July 15, 2024 however you may pre-order a replica to ensure you are a part of the primary print run by E-mailing: data@lolabooks.eu

The particular pre-order worth will likely be an inexpensive €14.00 (VAT included).

That’s sufficient for right this moment!

(c) Copyright 2024 William Mitchell. All Rights Reserved.