Gold is likely one of the favorite buying and selling devices of essentially the most profitable merchants at NordFX. This may be simply confirmed by wanting on the month-to-month rankings printed by this brokerage firm. That’s the reason it’s acceptable to offer a particular evaluation, focusing solely on the XAU/USD pair.

Is Gold Really a Protecting Asset?

● Within the present financial state of affairs, as main central banks worldwide try to curb inflation, the value of this valuable metallic has reached a historic excessive, hitting $2,080 per troy ounce on Might 4. Market individuals are dashing to purchase gold, believing it could possibly safeguard their capital from devaluation.

In keeping with a survey carried out by Bloomberg, roughly 50% of respondents recognized gold as their main safe-haven asset (with US Treasury bonds coming in second place, receiving solely 15% of the votes). Nevertheless, is gold really an efficient instrument for hedging worth dangers, or is that this a widespread false impression?

Take into account, as an illustration, the interval from March to October 2022 when gold costs fell from $2,070 to $1,616, a decline of virtually 22%. This occurred even if inflation in the USA reached a 40-year peak throughout that point. So, what sort of protecting asset is gold, then?

The Progress of Gold Costs

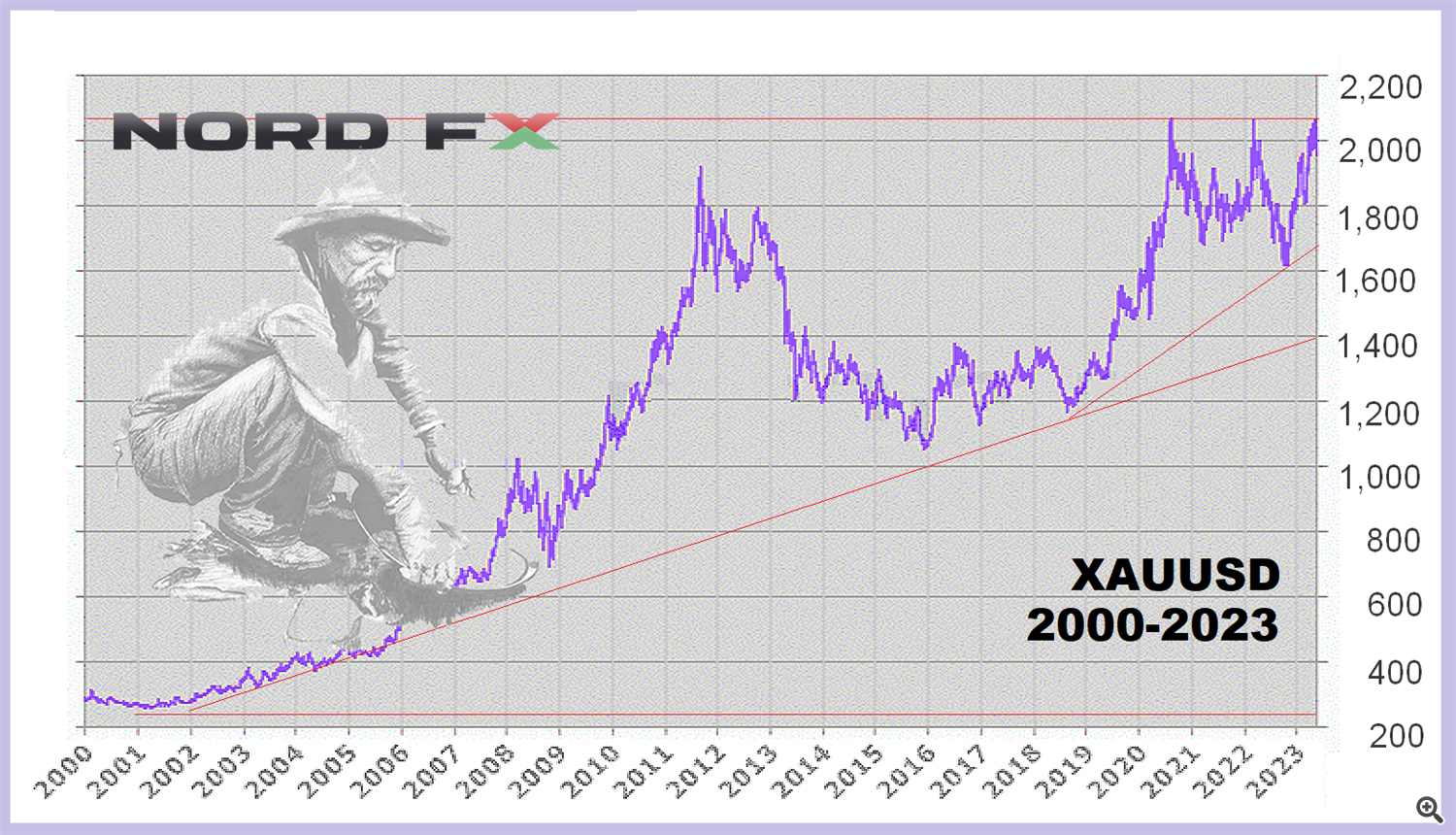

● If we hint the dynamics of gold costs because the starting of the twentieth century, we observe the next sample. Within the 12 months 1900, the value of this valuable metallic was roughly $20 per troy ounce.

Through the interval from 1914 to 1918, amidst and instantly after World Conflict I, the value rose to round $35. Then, within the Thirties, in the course of the Nice Despair and because of forex reforms in the USA, the value was set at $20.67 per troy ounce. All through World Conflict II, the worth of the asset remained steady and was mounted at $35 underneath the Bretton Woods system, the identical stage as throughout World Conflict I.

● In 1971, the USA deserted the gold commonplace, which led to floating change charges and a rise within the worth of gold. Within the late Nineteen Seventies and early Nineteen Eighties, the value exceeded the $800 mark per troy ounce resulting from geopolitical tensions, inflation, and a discount in gold manufacturing. From the Nineteen Eighties to the 2000s, the value of gold declined and fluctuated inside a variety of roughly $250 to $500.

● For the reason that early 2000s, there was a major enhance within the worth of gold resulting from geopolitical occasions, monetary instability, and inflationary pressures. In August 2020, amidst the COVID-19 pandemic and financial uncertainty, the value of gold surpassed the $2,000 mark per troy ounce for the primary time. Nevertheless, following this peak, it skilled a decline resulting from expectations of financial restoration, tightening financial insurance policies by central banks, rising rates of interest, and numerous different elements.

A subsequent unsuccessful try to interrupt above the $2,000 resistance stage occurred in March 2022. Lastly, the third surge occurred in Might of this 12 months.

Why Gold Costs Are Rising

So, what contributes to the worth of gold and why does its worth rise?

– Rarity and Restricted Provide: Gold is a uncommon metallic, and its extraction is proscribed and requires important efforts and sources.

– Sturdiness and Longevity: Gold is extremely immune to put on and corrosion. It retains its bodily properties over time, making it appropriate for long-term storage and enticing to be used in jewelry and numerous industries.

– Retailer of Worth: Gold has lengthy been thought of a retailer of worth. It will probably protect its buying energy over prolonged intervals, serving as a hedge towards inflation and the instability of shares and currencies.

– Liquidity and Recognizability: Gold is universally acknowledged and accepted as an asset. It may be simply exchanged for money or used as a medium of fee in several nations and cultures.

These elements contribute to the desirability and demand for gold, thus driving its worth upward.

Elements Influencing Gold Costs

Let’s delve into the elements that affect the value of gold. It is necessary to notice that there isn’t any direct correlation between the value of gold and every of those elements individually. Market forecasts and the mixture of those elements additionally play a job in figuring out gold costs. For instance, the latest surge in XAU/USD may be attributed to expectations of a reversal within the Federal Reserve’s rate of interest hike cycle, potential U.S. debt default, in addition to geopolitical and financial instability resulting from Russia’s armed actions in Ukraine. Now, let’s discover the important thing elements:

– Financial Circumstances: The worldwide financial state of affairs, together with GDP development or decline, unemployment, and total monetary stability, can influence gold costs. Uncertainty within the markets or a recession, as an illustration, could enhance demand for gold as a risk-free asset.

– Geopolitical Occasions: Political and geopolitical occasions resembling armed conflicts, wars, terrorist acts, sanctions, elections, and so forth., may cause market instability and uncertainty, resulting in an elevated demand for gold as a protected haven.

– Inflation: The extent of inflation performs a vital position in figuring out the worth of gold. When inflation rises, the value of gold usually follows swimsuit as buyers search safety towards the devaluation of cash.

– Central Banks: Actions taken by central banks, together with adjustments in rates of interest, can affect gold costs. For instance, a lower in rates of interest could stimulate demand for gold as holding it turns into comparatively extra enticing than different belongings.

– Forex Actions: Fluctuations in change charges between totally different nations may influence the value of gold. If the forex of a gold-producing nation weakens towards different currencies, the value of gold in that forex could enhance, stimulating exports and elevating the demand for gold.

– Funding Demand: Funding demand consists of the acquisition of gold bars, cash, and futures market transactions. Demand usually rises when belief in fiat currencies weakens.

It is necessary to think about the interaction of those elements and market expectations when assessing the value of gold.

Forecast: Will the Worth of Gold Rise?

● In terms of forecasts, it is necessary to notice that they’re mere assumptions based mostly on accessible data and evaluation. As talked about earlier than, the gold market is complicated and topic to the affect of a number of elements. Any forecasts are subjective assessments and might change relying on financial and geopolitical conditions, in addition to adjustments in market demand and provide. Nevertheless, it must be acknowledged that some forecasts have confirmed to be comparatively correct.

● Listed below are a couple of examples of such forecasts made earlier than September 2021. In Might 2021, analysts at Goldman Sachs predicted that the value of gold would attain $2,000 per troy ounce by 2024. Two months later, their counterparts at Financial institution of America made the very same forecast. The contact of this resistance stage occurred one 12 months earlier. Nevertheless, whether or not XAU/USD will have the ability to sustainably set up itself above this stage, turning it from resistance to help, stays to be seen.

Presently, Goldman Sachs strategists are indicating a goal of $2,200. In the meantime, the Swiss monetary holding UBS believes that the value of gold could rise to $2,100 by the tip of 2023 and to $2,200 by March 2024. (It is value noting that their earlier forecast projected a peak of $2,400 for this 12 months). Related figures are talked about by analysts on the Financial Forecasting Company, who imagine that the value of gold could even exceed $2,400, however that is anticipated to happen solely in 2027.

***

● Initially of this overview, we raised the query of whether or not gold is a protecting asset. In his early statements, Warren Buffett expressed scepticism about investing in gold, referring to it as an unproductive asset that does not generate earnings. Nevertheless, wanting on the chart, it turns into clear that he was mistaken. Even the legendary investor himself acknowledged this and later expressed a optimistic perspective in the direction of gold as a retailer of worth. Outstanding financier George Soros additionally acknowledged gold as a diversification asset that gives safety towards inflation and political instability. Ray Dalio, the founding father of funding agency Bridgewater Associates, beneficial together with this valuable metallic in a single’s portfolio.

Almost definitely, they’re all appropriate, and within the foreseeable future, gold will retain its position as a main capital preserver. Nevertheless, it’s at all times necessary to do not forget that the effectiveness of any funding relies on the entry level. If the timing of a commerce is chosen incorrectly, it’s potential that your deposit could begin to lower. However, within the case of gold, the chance of XAU/USD rising once more is considerably greater than that of many fiat currencies. To resist drawdowns and in the end obtain revenue, sound cash administration, in addition to time and persistence, are obligatory.

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx