To not point out, fluctuating residence values can considerably influence your monetary scenario, particularly if the market tendencies result in a lower in residence values over time, additional compounding the monetary burden on owners.

When you transfer once more inside a brief interval—for instance, 4 years—all these charges will dwarf any fairness beneficial properties you will have. Think about driving a automotive off the lot: Everyone knows that it immediately loses worth. The identical is true of your home, and it takes time to amortize (or unfold) the prices.

Most individuals keep of their home for lower than 8 years, and that quantity is the very best it’s been in a number of many years! Earlier than the 2008 monetary disaster, the common size of time Individuals stayed put was round 4 years.

Don’t give in to see stress to purchase a home for those who may not keep there for the long run. If you recognize you’ll transfer in fewer than 10 years, you’ll possible earn more money by renting and investing in S&P index funds.

-

Frequent mistake: “I’m not shifting for just a few years. I can purchase so I don’t throw cash away on lease!”

-

Actuality: When you purchase for a brief interval, if you consider all prices, you’ll nearly actually lose cash.

Is your whole month-to-month housing price decrease than 28% of your gross month-to-month earnings?

Your whole housing prices must be lower than 28% of your gross earnings, together with your month-to-month mortgage funds. When housing prices exceed 28%, you threat being overwhelmed with bills if one thing goes mistaken (e.g., an surprising restore, job loss, and many others.) Use the 28/36 Rule to see for those who can afford your housing.

Right here’s an instance:

-

Assume you make $10,000/month (that’s $120,000 per yr gross or earlier than taxes).

-

Assume your whole housing prices are $2,000 monthly, together with month-to-month mortgage funds. Nice! Your housing prices you 20% of your gross earnings. You go this check, and you may afford your housing.

-

Notice that whole housing prices embody the whole lot: taxes, curiosity, upkeep, furnishings, electrical energy, water, and even the roof restore 7 years from now (challenge it).

Evaluating the affordability of month-to-month funds is essential within the context of total monetary planning for a home buy. It helps in assessing whether or not you’ll be able to preserve your life-style with out compromising on different monetary objectives.

Why gross earnings? I exploit gross as a result of it’s simple to calculate. Everybody is aware of their gross earnings, and taxes complicate internet earnings (completely different folks select completely different deductions). Nevertheless, for those who want to make use of internet earnings, go for it! I like when folks create their very own factors of view on their funds.

Exceptions to the 28/36 rule

- When you stay in an HCOL (excessive price of dwelling) space like NYC or Los Angeles, many individuals stretch the 28% quantity to 35% and even 40%.

- In case you have no debt (e.g., no automotive fee, pupil loans, or bank card debt), you would possibly stretch the numbers slightly. I’d take into account going to round 33%, however I’m conservative with my funds.

- In case your earnings in all fairness anticipated to go up quickly, equivalent to with a job promotion, you might stretch the numbers slightly. Once more, I’d conservatively take into account going to 33%… perhaps.

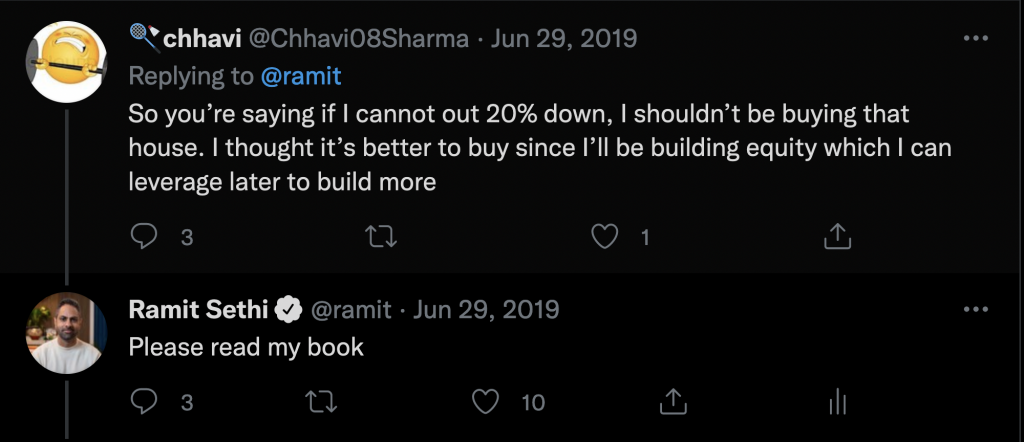

Have you ever saved a 20% down fee?

When you haven’t saved a 20% down fee, you’re not prepared to purchase a home.

Why? Not simply due to PMI, which is an extra charge you’ll typically pay if you get a mortgage with out 20% down.

The actual purpose to avoid wasting 20% earlier than shopping for is counterintuitive: constructing the behavior of saving is important earlier than you purchase and have surprising housing bills equivalent to a damaged water heater, roof, or surprising taxes.

I often get annoyed feedback about how “impractical” this rule is. “How am I supposed to avoid wasting 20%? That may take years!”

Sure, it’s going to—which is strictly why you need to save now. Saving is a behavior that’s higher practiced earlier than your mortgage is in danger. Moreover, consulting with varied mortgage lenders to seek out the very best mortgage phrases and charges can considerably influence your monetary planning. The Federal Reserve performs a vital function in influencing rates of interest, which may have an effect on how a lot that you must save for a down fee, highlighting the significance of understanding the broader financial components at play.

When you write a remark like this, you aren’t prepared to purchase a home.

Notice: I don’t imply that you need to put 20% down. In some circumstances, equivalent to low rates of interest, many individuals deliberately select to place a small quantity down. However you need to have the ability to.

Are you OK if the worth of your home goes down?

If you’re shopping for since you consider residence costs all the time go up, rethink: fluctuations in residence costs can considerably influence your funding, indicating that actual property just isn’t all the time the very best funding.

Listed here are some good causes to purchase a home

- You have got children, and also you wish to keep in your space or faculty district and construct reminiscences in the identical home for no less than 10 years 👨👩👦👦

- Your mother and father are shifting in with you 🧓

- You wish to design a home collectively along with your partner 📐

- You’re keen on repairing and tinkering with a home and making it your individual 🔨

- You simply wish to! 🫰

Discover what’s not on the listing: “You want the worth of the home to go up”. Possibly it’s going to—in that case, nice! Possibly, when you consider bills and alternative prices, you possibly can have gotten a a lot better return in a easy S&P index fund.

Purchase for the appropriate causes!

Are you enthusiastic about shopping for?

When you’re approaching shopping for a home with dread—like a heavy feeling of obligation or peer stress—simply cease. You don’t want to purchase and you need to by no means really feel responsible about renting. I lease by alternative. On this video I discuss why.