This was the second week in a row when the markets delayed their breakout and continued to flirt with the important thing ranges. This time, the markets continued to remain largely in an outlined vary whereas persevering with to withstand the important thing ranges. The NIFTY50 index stayed above the essential helps; on the similar time, it additionally failed to interrupt above the essential resistance zone. The buying and selling vary additionally remained slender; the index oscillated in a 246.30 factors vary earlier than closing on a flat be aware. Whereas staying utterly devoid of any directional bias, the headline index closed with a marginal achieve of 29.30 factors (+0.16%) on a weekly foundation.

From a technical perspective, two issues are delaying the in any other case imminent breakout. First, the not-so-strong market breadth. We’d typically want a lot stronger market breadth for any important breakout to first happen, after which to maintain itself. The opposite factor that warrants warning is the very low degree of INDIAVIX. The VIX stays at one in every of its lowest ranges seen solely throughout the pre-pandemic days. The low ranges of VIX depart the market weak to unstable profit-taking bouts at larger ranges. Markets must right each of those components earlier than it makes it for a serious breakout. If the breakout takes place within the current technical situations, we is perhaps in for some questionable rally within the markets.

All eyes can be on the FOMC assembly end result; the Fed is predicted to pause after eleven consecutive price hikes. Whereas a quiet begin is predicted for the week, the degrees of 18680 and 18885 are anticipated to behave as resistance for the markets. The helps are prone to are available at 18480 and 18365 ranges.

The weekly RSI is 62.18; it stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD is bullish and stays above the sign line.

The sample evaluation reveals that the NIFTY has a resistance zone of 18650-18750 to navigate earlier than it phases a breakout. Nevertheless, no sustainable up transfer is probably going as long as NIFTY is beneath this zone. In the identical means, any slip beneath 18600 ranges will push the markets below some extended consolidation as soon as once more.

All in all, within the occasion of any up transfer, we might want to preserve a detailed eye in the marketplace breadth because the energy of the rally might be essential as that might imply trying a breakout. Moreover this, the low ranges of VIX additionally shouldn’t be neglected because it retains the market weak to profit-taking from larger ranges. It is suggested to proceed approaching the markets in a really selective means and preserve defending income vigilantly at larger ranges. A cautious method is suggested for the approaching week.

Sector Evaluation for the approaching week

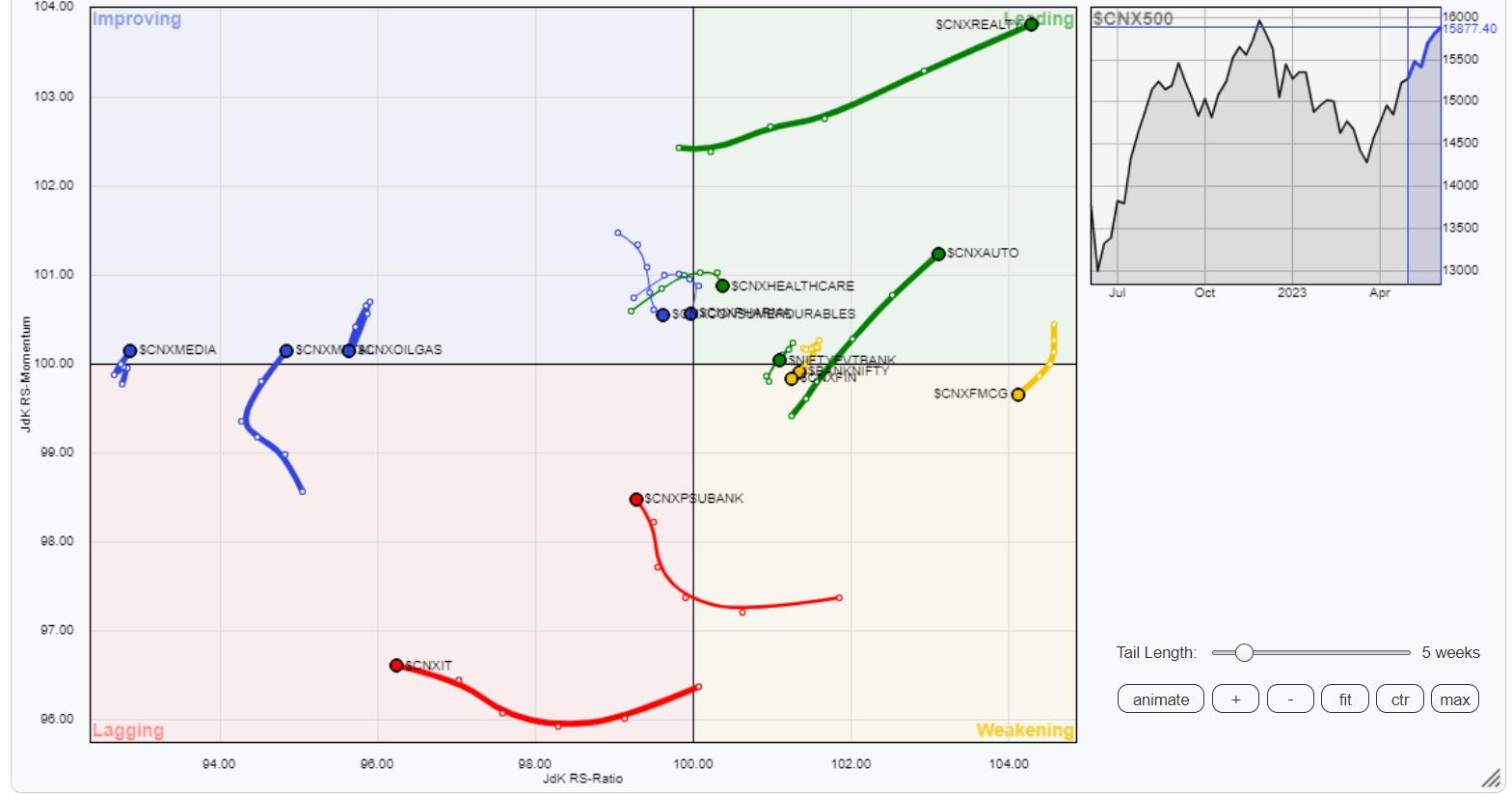

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) reveals NIFTY Consumption, Auto, and MidCap 100 indices are contained in the main quadrant and these teams can comparatively outperform the broader markets.

Nifty Monetary Companies and Banknifty have rolled contained in the weakening quadrant. Moreover this, the Infrastructure, PSE, and FMCG indices are additionally contained in the weakening quadrant.

The IT index continues to languish contained in the lagging quadrant. The Commodities, PSU Financial institution, and the Companies Sector Index additionally keep contained in the weakening quadrant.

NIFTY Steel and Media sector indices have rolled contained in the bettering quadrant. This will likely result in the start of a section of relative underperformance in opposition to the broader markets. The Vitality sector can also be contained in the bettering quadrant; nonetheless, it’s seen paring its relative momentum in opposition to the broader markets.

Necessary Be aware: RRG™ charts present the relative energy and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.